Nowadays, there are companies that make the claim that they can raise large amounts of money for a project in days or hours. But it’s becoming a reality thanks to the invention of the blockchain. As an extension of that, company projects can be financed by digital currencies. Just like when making World Cup picks, it’s important to look at all of the options from all angles.

For a while, blockchain seemed like it was reserved for experts. But this has changed recently as more and more companies are looking into cryptocurrencies and incorporating them into their businesses.

ICOs consist of the issuance by the applicant for the financing of a given digital asset, called tokens, in exchange for official tender, like euros or U.S. dollars. Investors can contribute with cryptocurrencies such as Bitcoin (BTC) to buy these tokens.

This funding method has a lot of potentials to change things for blockchain projects that don’t have a lot of capital. It could also get more money into the space by capturing funds from traditional venture capital funds. Regulators are paying attention because of their potential to bring together funds from different users and hit the right type of people.

SEC Pushes Back

As digital securities start to become big business, the Securities and Exchange Commission (SEC) has come out as the first regulator seeking to regulate all aspects of this type of company financing. To do this, it decided to analyze the DAO as an example, and while commissioners proved they could never be adept at making World Cup expert picks, they determined that the tokens issued should be considered securities by using the Howey Test.

The Howey test is a three-pronged test for determining whether an arrangement constitutes an “investment contract” – the equivalent of security. The second and third prongs are virtually identical to the ones in the traditional Howey test.

The first element tests whether investors are investing in something that is akin to a common enterprise, while the third tests what precautions were taken so as not to include securities in with things that are not.

Crypto Increases Banking Access

Basic banking services, like loans and current accounts, are mostly unavailable to two billion people. These people – who are often financially disadvantaged – must seek questionable loans and services with a high-interest rate as opposed to fair ones. The result is higher instability for those looking for any type of credit, resulting in more suffering.

One way that crypto can be used is to provide a high level of security, just like reviewing World Cup predictions from a legitimate sportsbook. There are now plenty of crypto applications and programs to help people get acquainted with crypto, such as Bitcoin stands. The great thing about cryptocurrencies is that they are decentralized. This means there are absolutely no restrictions on trading across countries.

Cryptocurrencies are on the rise, and the culture is gaining momentum. Using cryptocurrency will increase the number of various sectors where these are appropriate, as well as allow for more connectivity and empowerment around money.

Utility Tokens Offer Flexibility

To create a utility token, you have to set a fixed price. If the token is free, no investors will buy it for an investment. They would purchase it for its utility value rather than speculation.

This is a great way to raise money from people who need it. But it’s useless for raising large amounts of capital, which is the point the SEC wants to regulate it as. The nature of ICOs contributes to this determination-that they’re factors that will come into play when determining if ICOs become subject to statutory securities regulation.

Blockchain was first associated with new digital currencies, but today it is used for many different tasks. For example, it can be used to do cloud computing without loss of information, to manage copyrights, or to have an unforgeable repository of information.

A blockchain is a handy way to store and modify data in a secure and verifiable way. As a result, many businesses are adapting well to this new technology.

- [ANSWERED] What Is Chase Bank Teller Withdrawal Limit? - July 3, 2025

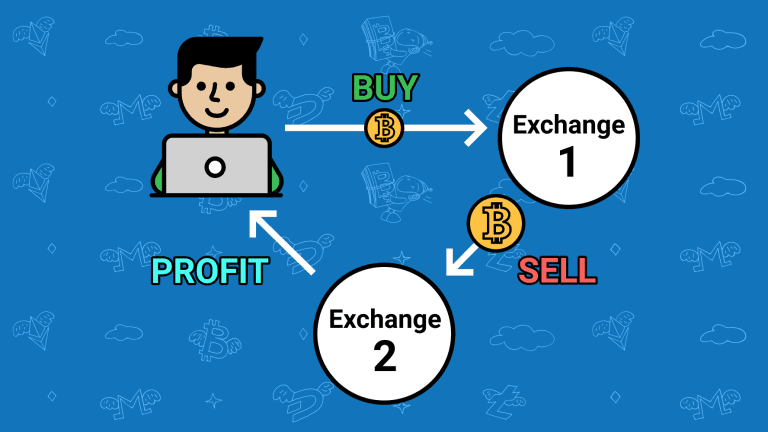

- The Complete Guide to Crypto Arbitrage - July 3, 2025

- Does Taco Bell Take Google Pay? - July 3, 2025