With over 6,000 locations and millions of clients, Chase Bank is one of the most popular and greatest banks in the United States of America.

Every bank, including Chase Bank, has a withdrawal restriction that varies depending on the kind of withdrawal method employed.

For example, an ATM has a daily withdrawal limit, while the withdrawal limit for a Chase bank teller is different. In this article, I will break down the different chase bank teller withdrawal limits for different account types and limit conditions. Read on

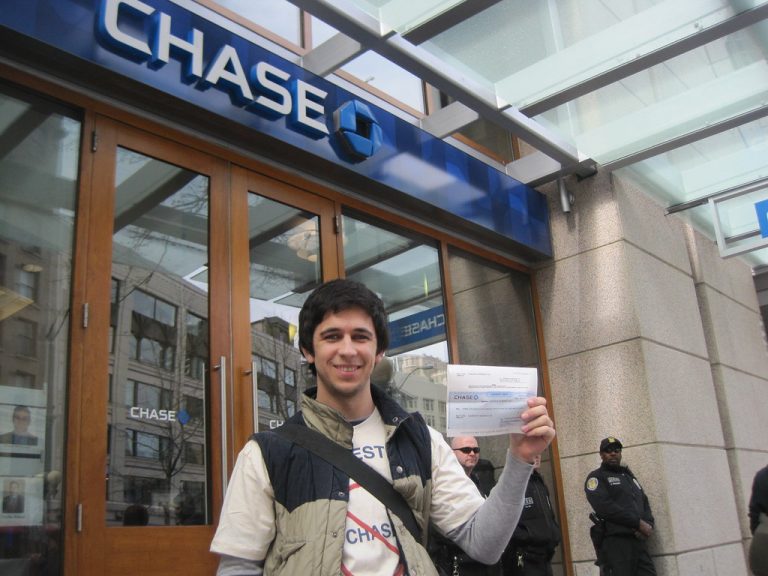

![[ANSWERED] What Is Chase Bank Teller Withdrawal Limit? 2 What Is Chase Bank Teller Withdrawal Limit](https://milvestor.com/wp-content/uploads/2022/05/What-Is-Chase-Bank-Teller-Withdrawal-Limit-scaled.jpg)

What Is Chase Bank Teller Withdrawal Limit

Chase Bank has a limit of $3,000 per day and $10,000 per month for teller withdrawals. This is the limit set by the Federal Deposit Insurance Corporation (FDIC). If you go over that amount, Chase will charge you a fee for each transaction.

This means that if you go to a Chase branch and withdraw $2,500 from an ATM or teller window, then the rest of the money in your account will be temporarily unavailable until after midnight that night when the bank updates its records.

The amount of the fee depends on your account type. For example, if you have a business account, Chase charges $5 per transaction over $1,000.

Basic Checking Account

Checking Accounts: If you have a checking account with Chase bank, then your daily withdrawal limit is up to $1000 (or equivalent currency) per day.

This limit is imposed on every customer regardless of their age or the country they reside in. However, if you need more than this amount per day, then it is possible for you to request an increase in your daily limit through the bank’s website or by visiting one of its branches. You will receive notification by mail within 3 business days after your request has been approved or denied by the bank

The Chase Bank Premier Checking Account:

This account type has a $3,000 daily cash withdrawal limit. You can make up to six withdrawals per month from your account.

Chase Bank has defined the $10,000 limit and the six withdrawals as follows:

Each day, you can withdraw up to $1,000 from an ATM or in person at a branch location. You can also make up to five other withdrawals of $100 or less per day at ATMs or in person at branch locations.

You can make up to two additional withdrawals each calendar month of up to $500 each

Limits set out in Regulation D

The quantity of money you may remove from a savings or money market account is limited by Rule D, a federal regulation.

Six withdrawals per month are allowed via internet banking, telephone banking, overdraft protection, and pre-authorized transfers.

Your bank may terminate your account or convert it to a non-interest-bearing account if you exceed the monthly withdrawal limit three times.

Other sorts of withdrawals, such as those made through ATMs or via a teller, are limitless.

Checking accounts, which are formally known as demand deposit accounts since you may demand access to your cash at any time, are exempt from Regulation D.

Limits on Certificates of Deposit

When you purchase a certificate of deposit (CD), you are agreeing to keep your money in the account for a certain length of time.

The CD earns income, and when it matures, you may withdraw both the principle and the interest.

If you take CD cash before the account matures, you will usually be charged a penalty fee.

Your interest earnings, as well as your principal, may be reduced as a result of the penalty costs.

Some banks provide “no-risk CDs,” which allow you to withdraw funds at any time without incurring penalty fees.

No-risk CDs, on the other hand, often pay lower interest rates than ordinary CDs.

Requirements for a Minimum Balance

![[ANSWERED] What Is Chase Bank Teller Withdrawal Limit? 3 What Is Chase Bank Teller Withdrawal Limit 2 scaled](https://milvestor.com/wp-content/uploads/2022/05/What-Is-Chase-Bank-Teller-Withdrawal-Limit-2-scaled.jpg)

Although withdrawals from checking accounts are unrestricted, there are times when taking money out of the bank might be costly.

Checking and savings accounts at certain institutions have minimum balance requirements.

When your balance goes below a specific level, you must pay a monthly service charge.

Aside from expenses, savings accounts sometimes offer tiered interest rates, meaning you receive less money if your balance falls below the necessary minimum.

If you join up for additional services like direct deposit or internet banking, some banks may eliminate the minimum balance requirement. This means you may access your funds whenever you want without incurring any costs.

What Is Chase’s Daily ATM Withdrawal Limit?

Your withdrawal limit for many Chase checking accounts will be $500 to $1,000 per day, and your purchasing limit will be $3,000 to $7,500 per day. During business hours, however, you may take advantage of larger withdrawal limitations by visiting the in-branch.

When you go to a Chase bank during business hours, you may normally withdraw substantially larger amounts from the ATMs. My regular $500 daily limit extends up to $3,000 in my situation, so the limit may be much higher.

The limit for in-branch ATMs is different from the limit for non-branch ATMs. Because the limitations are different, you should be able to take $3,000 from a Chase bank and then withdraw another $500 from a Chase ATM (not located at a branch).

The in-branch limit, however, applies to all of your Chase debit cards, so you wouldn’t be able to withdraw $3,000 in-branch with one Chase debit card and then go back to Chase and try to withdraw $3,000 in-branch with debit card #2 on the same day.

Also, the Chase ATM withdrawal limit varies depending on the kind of Chase checking account you have and maybe the state in where you started your account. Simply contact the phone number on the back of your Chase debit card for the most up-to-date information.

How long does the Chase ATM withdrawal limit revert?

Every 24 hours, the Chase ATM withdrawal limit will be reset, allowing you to take $500 or $1,000 on consecutive days if you like. The actual time of the reset is midnight Eastern Standard Time (EST), so make your withdrawals accordingly.

I’ve heard of individuals successfully double-dipping on ATM withdrawals by waiting until the clock strikes midnight and then withdrawing soon afterwards.

ATM withdrawal limitations for student cards

Your restrictions may be substantially lower if you hold one of Chase’s student cards, such as a High School debit card. Your withdrawal limit, for example, maybe set at $500, but your buying limit could be considerably lower. Keep in mind that certain student cards are simply ATM cards and cannot be used for any transactions.

How much can you withdraw from an international bank account at a time?

The overseas withdrawal limit should be the same as your domestic withdrawal limit. However, unless you have a particular kind of account, such as Chase Private Client or Sapphire Banking, you will be charged fees for the overseas transaction.

If you’re going out of state, such as from California to New York, your ATM withdrawal limits should be the same. You may be restricted to lesser limits at non-Chase ATMs in certain instances. For example, if your ATM limits are $1,000, you may be restricted to $500 for non-Chase ATMs. Again, calling the customer support number on the back of your debit card for further information is an excellent idea.

Chase withdrawal limit increase

The maximum amount that may be raised varies depending on the consumer. You may be able to boost your daily limit from $500 to $1,000 in certain circumstances, but it may be a lesser or greater sum in others.

If you join up for a Chase Sapphire banking account or a Chase Private Client account, you’ll be able to enjoy larger withdrawal limits. For example, depending on the area, Chase Private Client may allow you to withdraw up to $2,000 or even $3,000. In addition, your daily purchasing limit will most likely be approximately $7,500.

With Chase, you may be able to raise your withdrawal limit. There are two ways in which this might occur.

The first is that you are granted a one-time boost. These are useful when you simply require a little amount of money for a special occasion or another form of expenditure. It’s typically not difficult to get a temporary rise, particularly if you can provide Chase with a clear explanation for why you need it.

A permanent rise is the second sort of increase. You’ll probably need to retain a particular amount of money in your bank account (say, $1,000 per day) to achieve a permanent rise. As a result, these types of raises will be more difficult to get.

The Premium Platinum Debit Card, which has a $3,000 limit at Chase ATMs, is another alternative with a larger limit.

Simply contact Chase’s customer care hotline at 1-800-935-9935 to seek a higher credit limit.

It will help if you can explain why you need a higher credit limit to the agent, just as it will help if you can explain why you need a higher credit limit.

Frequently Asked Questions about Chase Withdrawal Limits

How much money can I get from a Chase ATM?

Withdrawals at Chase ATMs are typically limited to $500 to $1,000 per day.

If you have a premium bank account, however, you may be allowed to withdraw larger sums ranging from $2,000 to $3,000.

What are my options for increasing my withdrawal limit?

During business hours, you may usually withdraw far more than your daily limit from an ATM by walking inside a Chase bank.

You may also seek a temporary increase in your ATM withdrawal limit by calling Chase.

How can I find out how much money I can withdraw?

![[ANSWERED] What Is Chase Bank Teller Withdrawal Limit? 4 What Is Chase Bank Teller Withdrawal Limit](https://milvestor.com/wp-content/uploads/2022/05/What-Is-Chase-Bank-Teller-Withdrawal-Limit-4-scaled.jpg)

Because various accounts have varying withdrawal limitations, calling the number on the back of your debit card is the easiest method to find out what yours is.

When is my withdrawal limit going to be reset?

At midnight Eastern standard time, the withdrawal limit will be reset.

What is the maximum amount of money you may withdraw from an overseas ATM?

The foreign ATM withdrawal limit will most likely be the same as the US limit.

How much money may I withdraw out of the bank?

If you’re withdrawing money from a teller at a Chase location, there should be no restriction on how much you may take out.

What are the ATM costs for non-Chase withdrawals?

The costs you pay will be determined by the kind of bank account you create.

You won’t be charged ATM fees if you use non-Chase ATMs if you have a Chase Sapphire or Private Client account.

A basic account, on the other hand, will cost $2.50.

- How To Sell Unwanted Gift Card For Cash - March 7, 2024

- Does Circle K Take Google Pay? - January 31, 2024

- Where To Redeem Gift Cards In Nigeria - January 31, 2024