Investing in cryptocurrency can be a wise decision as it stands to be an excellent investment with astronomically high returns overnight. There is also a downside to it. Just as you can get a high return overnight, it can dip overnight. Users must carefully source the perfect investment opportunity.

Cryptocurrencies have become a growing trend in the financial world because of the many benefits that are available. Undoubtedly, when the needs come up, you can see the opportunities. It is almost the same as betting on sports, such as making NFL picks against the spread, to holding your asset, it is all about what you want.

This article will help suggest investment opportunities in crypto so newbies can try to make more money rather than just acquire bitcoin for sales purposes. Below are six investment opportunities accessible to a fresher in the crypto world.

Yield Farming

Yield Farming is a means of growing crypto by lending digital tokens to a decentralized exchange for it to able to offer buyers and sellers sufficient levels of liquidity on a particular trading pair. It is more of an investment opportunity available at cryptocurrency exchanges.

As the name implies, it means putting your coins to use by growing them. Yield farming crypto enables users to increase their investment while also having positive effects on the overall state of the coin. It doesn’t require an initial investment other than the crypto already in your wallet. So, getting into it is pretty easy, and you can start in no time, depending on what you want.

Staking

Staking can be defined as the locking of crypto assets for a particular time to contribute to and support the operation of a blockchain network. In return, you earn passive income without needing to sell your cryptocurrency. Staking in crypto can be seen as a less resource-intensive alternative to mining.

Staking in cryptocurrency gives users a higher return than what users can get in a savings account. The higher the cryptocurrency value at stake, the better chance a user has of earning a transaction fee reward. It is an investment that can keep you active in the crypto space.

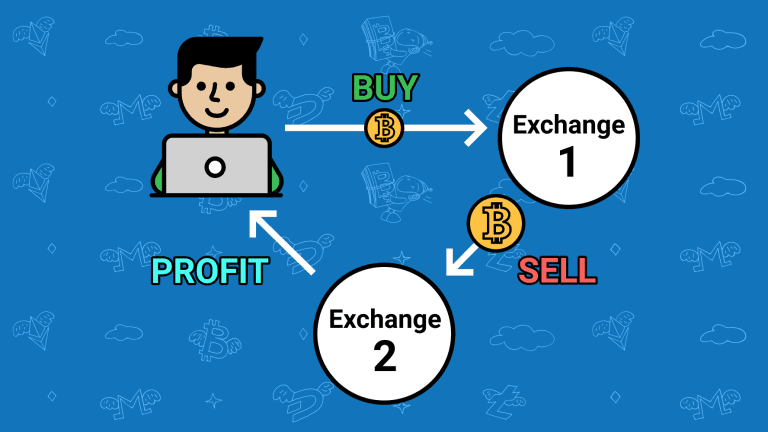

Trading – Futures and Spot

A spot market is where financial instruments like commodities, currencies, and securities are traded for prompt delivery, known as swapping cash for the financial instrument. On the other hand, the Futures market is based on the underlying asset delivery price at a future date.

Spots markets can be said to be “physical markets’ because trades are exchanged for the asset straight away. While the Future contract is said to accept a specific price, the delivery and transfer of funds will be later. These investments are riskier than most of the options on this list, but they promise a much higher return than others.

Holding

Holding, also known as HODL, which was coined from a misspelled word, is a famous slang used by crypto investors for buying and holding cryptocurrency regardless of the price increase or decrease; they hold on to it to profit from its long-term value appreciation.

What makes Holding a great choice is that it brings about safety to investors, meaning they are safe from the short-term volatility of the market and don’t have to go through the risk of buying at high prices and ending up selling at low prices.

It is to be noted that investors are advised to have a financial backup sufficient enough to keep them away from forceful sales for whatever reason that may arise.

Token and NFTs

Non-fungible tokens, also NFTs, are cryptographic assets such as a piece of art, digital content, or media with unique identification codes and metadata that help tell them apart from others.

NFTs, unlike Bitcoin and Ethereum, cannot be traded identically nor replaced, making them unique. Other cryptocurrencies can be traded or exchanged since they are fungible.

Vault

A Vault in crypto is a separate account that keeps your cryptocurrency more securely. A vault can receive cryptocurrency like a regular asset balance in your account.

Still, it can also halt stored crypto from being immediately withdrawn by adding optional security steps such as co-signing by the user’s invited trusted individual and going through a secure approval process after creation.

Interest is being earned daily on Vault, which directly means for assets left on the platform, each day you earn interest, the interest accumulates and is paid on a particular day of each week.

- [BEST ANSWERS] Does King Soopers Take Google Pay? - July 5, 2025

- WeightRX Review: How to Lose Weight Safely - July 5, 2025

- Does Wendy’s Take Google Pay? - July 5, 2025