Cryptocurrency took the world by surprise with the astronomical returns investors gained during its boom. Everyone wanted to be a part of it for fear of missing out until it began to decline, causing massive losses to investors.

The cryptocurrency market and college football picks have one thing in common. They can be volatile. This volatility has investors wondering whether to invest, even as they struggle with the fear of missing out.

It’s a good thing you are reading this because this article seeks to ensure that if you decide to take the cryptocurrency route, you can go in armed with fool-proof tips that ensure your investment boat does not sink.

What Is Cryptocurrency?

Cryptocurrency is a digital currency that serves as an alternative form of payment. It was created using an encryption algorithm and can function as a virtual accounting system. It is decentralized, meaning the government has no control over the use and trade of cryptocurrency, and banks are eliminated as intermediaries.

Cryptocurrency payments exist solely as digital entries in an online database that describes specific transactions. Blockchain technology is used to create this digital ledger of cryptocurrency transactions, making it hard to hack information.

Examples of Cryptocurrency

Cryptocurrencies include thousands of digital currencies. The most common examples include,

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Litecoin (LTC)

- Tether (USDT)

Fool-Proof Tips for Investing in Cryptocurrency

Investing in Cryptocurrency? Carefully consider the following recommendations before you leap;

- Research

It is essential to carefully research and understands the investment vehicle you intend to use. The currency, its security, and its features are some important factors to consider. Don’t assume that all cryptocurrencies are the same, as they have different characteristics.

Book a consultation with a crypto expert and read the whitepaper of the coins you are considering. A whitepaper is a document highlighting the features and protocols of a project.

- Develop a Strategy

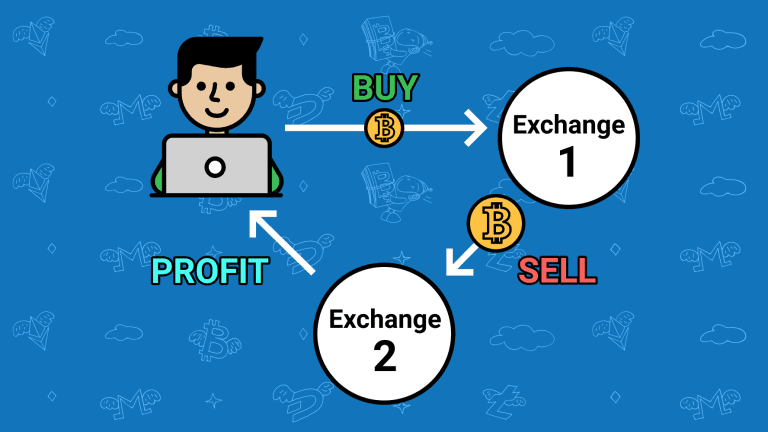

After understanding and choosing your preferred cryptocurrency coins, make a clear-cut strategy that involves the technique you intend to employ. There are various strategies to choose from like;

- Short-term trading: Here, you buy cryptocurrency to sell in the near future for a profit. If you choose this strategy, you need to monitor the market consistently and have technical analysis knowledge.

- Long-term trading (Holding): Here, you buy a crypto asset and wait for long-term until it is well appreciated. This strategy requires basic knowledge and patience.

- Crypto-Lending: Crypto lending is depositing cryptocurrency and lending it to borrowers in exchange for regular interest payments.

Consider individual risk factors when picking a strategy, and invest what you can afford to lose.

- Diversify

Your crypto portfolio shouldn’t have only currency, no matter how high performing it is. It is essential to diversify, that is, invest in several high-performing cryptocurrencies. It lowers your risks since various cryptocurrencies perform well at different times.

When diversifying, ensure that your crypto assets are not reliant on the same blockchain ecosystem. Cryptocurrencies based on the same blockchain system often react similarly, so there is no diversification in your portfolio.

- Ensure Your Crypto Goals Are Realistic

Setting realistic goals based on proper understanding and research saves you from heartache and losses in the crypto market. The media often portrays crypto as a get-rich-quick route, but that is not usually the case.

Manage your expectations, keep contributions consistent, and take pride in the little successes.

- Do Not Trade Based on Emotions

An essential requirement for trading is the ability to shove sentients aside when making buying or selling decisions. Having a predetermined strategy can help tremendously. Avoid market chart obsessions, and be prepared for some losses.

- Invest Automatically

Even after years of research, determining when to select, monitor, and trade a cryptocurrency can be complicated and time-consuming. Automated trading software allows you to conduct your trades with minimal effort.

- Risk Management

Risk management practices define how to handle risk during trading. They shield you from trade risks and keep you in control of your losses. Have a solid trading plan, calculate your risk-to-reward ratio, and use a stop-loss order. A stop-loss order helps specify an exit point in the market.

Strict adherence to these recommendations will simplify your cryptocurrency journey. Your investment decisions should rely on a deep knowledge of your investment vehicle, yourself and your goals.

- How To Sell Unwanted Gift Card For Cash - March 7, 2024

- Does Circle K Take Google Pay? - January 31, 2024

- Where To Redeem Gift Cards In Nigeria - January 31, 2024