On the face of it, bitcoin and gold could not be more different. Bitcoin is a virtual currency created from computer code. Gold is a yellow metal that has been considered valuable for millennia.

And yet both have become popular hedge assets for nervous investors looking for something reliable in uncertain times. Bitcoin’s price has risen nearly 500% this year, and gold prices are up 17%.

But bitcoin is the ideal investment vehicle, says Hedgeye CEO Keith McCullough, because it’s not subject to the same forces as gold.

“Gold never had a supply shock,” McCullough told Business Insider on Thursday. “Bitcoin had a 2,000% supply shock when miners were shut in.”

The price of gold may rise or fall in response to geopolitical tensions and central-bank monetary policy, but its supply is constant — meaning that if demand increases, so too do its price.

That’s an essential distinction between gold and bitcoin: the latter has a fixed supply of 21 million coins that will ever be in circulation. Once all 21 million have been mined (a process expected to take another 120 years), there will be no new bitcoins available to market participants.

Despite a recent slump in the cryptocurrency market, Bitcoin has increased in value by more than 880 percent over the last five years. Meanwhile, gold prices have risen by just 4.3 percent over the same period.

As reported by CoinDesk, economists Hanna Halaburda and Miklos Sarvary concluded that Bitcoin is more than twice as effective at retaining its value in the long term as gold, with volatility being one key factor that makes it a better investment vehicle than precious metals.

Gold and Bitcoin both have their uses as investment vehicles. For example, gold can be used as a hedge against inflation and other economic uncertainty. It also has some industrial applications, but its primary value lies in its use as an investment tool.

Bitcoin similarly has both practical applications and is used as an investment vehicle. It is a Decentralized Digital Currency (DDC), but it is also valuable because it is an investment vehicle.

Although Bitcoin and Gold have many similarities, they are very different assets. There are many reasons why Bitcoin is far superior to gold in investing.

This article looks at some of the most significant advantages Bitcoin has over gold.

What makes money valuable? Three main properties define good money:

Divisibility: Money must be divisible into smaller units of value to facilitate exchanges (ex., 1 dollar can be split into 100 pennies)

Portability: Currency must be portable and durable. Money should not take up too much space and should withstand time and natural elements like fire, water, and wind.

Fungible: Money must be fungible, meaning that every currency unit must have the same value as another currency in circulation. (ex. 1 U.S. dollar is equal to 1 Euro or 1 BTC. They’re all worth roughly $1)

Commercial Value: Bitcoin’s most significant advantage over gold is that you can use it to make purchases. While you can’t buy much with Bitcoin right now, merchants worldwide are slowly warming up to accepting it as a form of payment.

If you hold gold in your portfolio, you can’t be sure that the price will go up because there isn’t much demand for it. You can be confident that Bitcoin will get into more hands as time passes.

The Case for Bitcoin

Bitcoin’s massive price rise over the past few years has had many people call it the new gold. However, the comparison is misguided. Not only is Bitcoin much better than gold, but it’s also in a different league entirely.

- Institutional Demand

Gold has long been viewed as a value store by individuals and institutions. However, that’s all beginning to change — some of the world’s largest financial institutions are starting to dip their toes into Bitcoin waters.

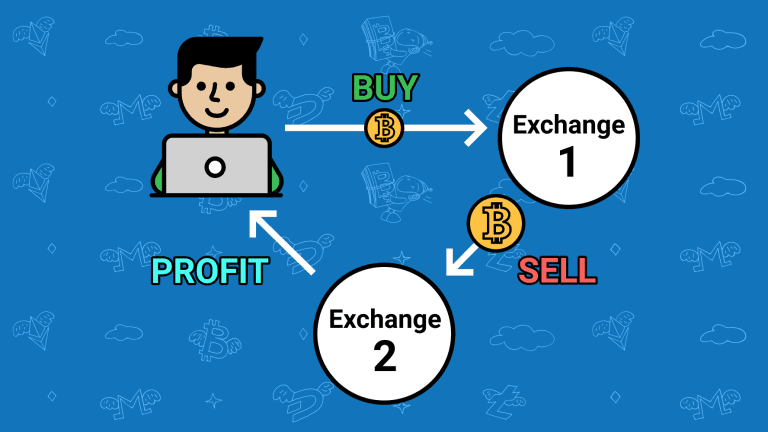

For example, take CME Group’s recent announcement to launch Bitcoin futures contracts. Futures contracts allow investors to buy an asset at a future date for a fixed price, which means they can profit from rising or falling prices without ever having to own the asset itself. This makes it easier for investors to get exposure to a purchase without owning it.

Also, when buying almost any other type of investment (e.g., stocks), there are always fees involved — commissions on stock trades, management fees on ETFs, etc. While there are still fees involved with trading bitcoins, these fees are usually substantially lower than those associated with other investments. This is particularly true when compared to gold-

The arguments for bitcoin over gold are built upon the core assumption that bitcoin is a better form of money than gold.

- Bitcoin is more accessible to more than gold.

Bitcoin is easier to transport. Let’s say you are an investor who wants to hold gold as a store of value. You have to get bars or coins, which you will most likely store in a safety deposit box at your bank. That means you have to go to the bank to see your investment.

Now, let’s say you want to buy Bitcoin in order also to keep it as a store of value. All you need is a computer, some Bitcoin wallets, and software that allow you to secure your private keys offline (paper wallets).

And even better, if you don’t like the idea of keeping it on your computer, then all you need is to write down your private key on paper and place it somewhere safe where no one can access it.

The excessive eccentrics who invest in gold do not believe that it can be displaced since it is a metal that dazzles the ambition of many with a trajectory without significant drops in its values over the years.

The use of gold in the real world is evident and notorious in our environment, whether in coins, jewelry, or other decorative items, and a great history supports it.

- Bitcoin has outperformed Gold Every Year Since its Launch.

There have been many speculations regarding the prices of Bitcoin for this New Year that promises to be shocking and reach values of hundreds of thousands of dollars, making it solid and in demand worldwide.

This type of controversy puts traditional gold in check. Despite being a solid asset for centuries, it runs the risk of being left behind, not permanently but overshadowed by the Bitcoin that it is and will continue to be the most liquid asset for many in the world.

Notably, the cryptocurrency market is never dormant, as genuine and remarkable as when it first opened at midnight on New Year’s Eve.

The price differences between the two assets are stark; gold increased by 10%, while Bitcoin increased by 60%.

Analysts and economic experts are interested in these things and think this cryptocurrency will eventually replace all metals and currencies, both online and offline.

We must be attentive to all the daily information about future forecasts in the economy and follow the trend with the most acceptability and demand.

The goal is to keep up with new forms of trade and investment, forecasting profits and growth in digital markets.

The price of Bitcoin for these subsequent years is stipulated to exceed $ 100,000, reaching a record in its entire trajectory, which makes it the most sought-after, established, and reliable cryptocurrency worldwide, followed by Ethereum and others.

- Bitcoin changes the way investors think

These evaluations make the majority change how they think about investing their assets in more revalued ones.

Even BITCOIN being volatile and without solid backing, it leaves aside the metal that for years has supported and maintained large capitals in solidity; that is why it is considered that the new era will be digital gold.

Although very few will still maintain their position, showing indifference to this change and progress, keeping their traditional and monotonous thoughts.

It is time to face new decisions, which represent promising progress in all economic areas of the world.

The new change in virtual commerce provides excellent advantages to achieve the decentralization of the economy and autonomy on the part of asset owners, providing the best personal management of their capital, a very relevant aspect without the intervention of third parties.

Strength of Bitcoin as a digital currency

Cryptocurrencies, particularly Bitcoin, are one of the most solid and representative; it is considered digital gold, thanks to their high value registered in recent years.

Bitcoin and gold are generating a great controversy in our way of thinking regarding investments, profits, and the future.

Thanks to the highly restricted acceptance of the use of cryptocurrencies, it is possible that in a short time, they displace gold as an alternative currency and position themselves as the only profitable and reliable virtual currency in the world. Especially, as Android smartphones simplify Bitcoin trading nowadays.

In 2020, acquiring fractions of a complete unit of bitcoin made the cryptocurrency accessible to a broader public.

As well as the named and recognized payment services company PayPal allowed its users with account holders to carry out online transactions with this crypto.

These strategies provide significant advantages for the growth of investors in Bitcoin.

Conclusion

Cryptocurrencies are the best investment option for the future. However, it does not represent a profit in the short term; with patience, optimism, and dedication, significant results can be achieved in the medium and long time.

Achievements, successes, profits, and economic progress for many in general, are based on the birth of digital gold that is already a fact.

That is why it is crucial to take advantage of investment opportunities in assets that will be the future of many, although they seem strange now.