A counter check refers to a personal check printed by the teller on the spot in today’s world. It contains all the client’s account information and is intended to be used as a regular check if the customer runs out of checks or misplaces his checkbook. Because counter checks are not a standard service, the holder may be charged a small price.

![What Is A Counter-Check? [Best Answer] 2 What Is A Counter-Check?](https://milvestor.com/wp-content/uploads/2022/03/What-Is-A-Counter-Check--1024x732.jpg)

Since they will be accepted by an authorized bank agent in the actual physical presence of the account holder, these checks are usually simple forms with no elaborate security safeguards that personal or corporate checks have.

If you’re in a pinch and can’t wait for your new checks to arrive, your bank can usually provide you with numerous fast counter checks to cover your interim needs. A teller or personal banker can print counter checks.

The most common applications for counter checks:

- Bills, rents, utilities, and auto payments can all be paid with counter checks.

- The process will be much more difficult by counter checks that do not have a check number.

- Ordering pre-printed checks with check numbers issued by the check design firm or directly through any bank is the best approach to use the counter check.

Before your official statements arrive, you will most likely be offered many counter checks when you initially open an account with a bank. They’ll be pre-printed with your account details and function similarly to regular inspections.

Counter Checks Vs Personal Checks

| Personal checks | Counter check |

| Most bank customers are likely to be familiar with the personal check. Most checking accounts, with a few exceptions, still allow you to purchase personal checks that you can use to make payments, and some checking accounts even offer complimentary checks to account holders. | The proceeds from a certified check are pulled from the signatory’s checking account, much like a personal check. On the other hand, an accredited check differs from a private check-in in that the bank validates that the account holder has sufficient funds in their account to pay the check. |

Keynote

A bank representative signs the check in addition to the account holder’s signature. The phrase “certified” or “accepted” is printed anywhere on the cheque. A certified check can cost up to $15 at some banks.

The counter verifies the accuracy of handwritten account information, but due to the danger of fraud, many businesses do not accept these checks as a form of payment.

Typically, the cashier will examine the signature, account information, and a personal photograph of the account holder to ensure that the person making the withdrawal is the rightful owner. Under normal conditions, these withdrawals cannot be performed for a third party because of the high risk of fraud.

What Is The Procedure For Obtaining A Counter Check?

Go to your bank or credit union’s branch to get a counter check. Call beforehand to make sure counter checks are accessible before going to the department.

Learn about the procedure and whether you’ll need to employ a specific branch. Of course, because there is no branch to visit, you won’t be able to get counter checks if you use an online-only bank.

When you arrive at the branch, ask the teller or personal banker to print the checks, verify your identification, and complete any other processes the bank requires. In just a few minutes, you should have your checks in your hands.

![What Is A Counter-Check? [Best Answer] 3 What Is A Counter-Check?](https://milvestor.com/wp-content/uploads/2022/03/What-Is-A-Counter-Check-1--1024x579.jpg)

How To Write A Counter Check

The following procedures must be followed to write the counter checks:

- Mention the customer’s name and address when writing the counter check.

- He should also include his contact information, such as his phone number, driver’s license number, or social security number.

- The client must choose a handwritten check number in the top corner for each check.

- When you open a new checking account, the bank will issue official bank checks to you.

- Customers should now use the new official checks instead of the counter checks.

Official checks are a good choice because they include the customer’s name and address. Account number, bank routing number, checking account number, and check number printed sequentially.

The Advantages Of Counter Checks

- The most significant advantage of a counter check is getting paper checks right now instead of waiting for a check shipment order to arrive.

- You can receive the counter check promptly by going to the bank.

- The bank charges a small printing fee for the counter check. You must pay between $1 and $2 for every check-in regularly.

- You can order counter checks based on your requirements, and you can even conduct one review at a time rather than waiting for 50.

The Disadvantages Of Counter Checks

Counter checks are not issued to most businesses and retail establishments because they are not official checks. Utility businesses and lending companies, on the other hand, accept counter checks as a form of payment.

![What Is A Counter-Check? [Best Answer] 4 What Is A Counter-Check?](https://milvestor.com/wp-content/uploads/2022/03/What-Is-A-Counter-Check-2.jpg)

Many counter-check users believe that taking counter-checks carries a high risk because the person does not yet have a standard account. Furthermore, banks can charge a printing cost of up to $2 per check, and they can only print a limited number of reviews at a time. Because counter checks are written by hand, retailers consider the danger of fraud.

Counter Checks Fees Compared at the Top US Banks

| Bank | Counter Checks Fees |

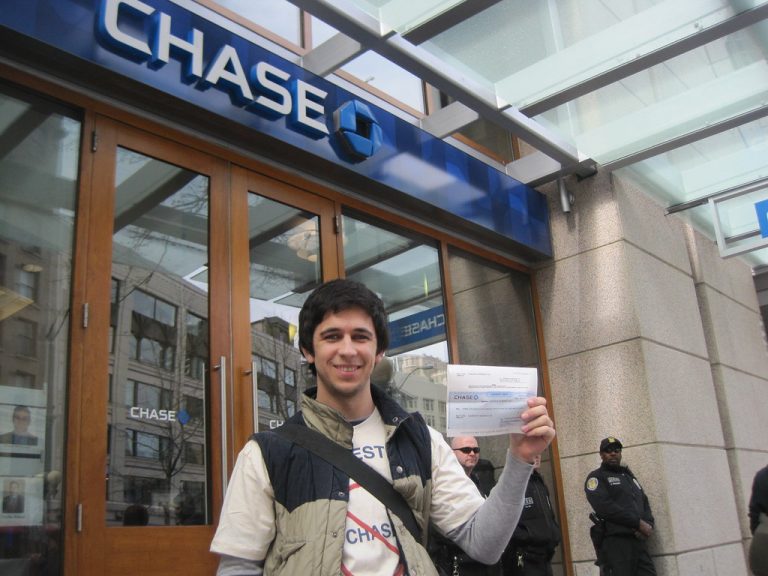

| Chase | $8 |

| Bank of America | $10 |

| Wells Fargo | $10 |

| Citibank | $10 |

| U.S. Bank | $7 |

| PNC Bank | $10 |

| Capital One | $10 |

| TD Bank | $8 |

| BB&T | $10 |

| SunTrust | $8 |

| Fifth Third Bank | $10.75 |

| Citizens Bank | $3 |

The highest costly cashier’s check is now $10.75. Remember that these statistics indicate the cost to essential checking account customers at a specific bank. If a consumer has a high-tiered checking account, several banks may waive cashier’s check costs.

If you are not a bank customer who plans to purchase a cashier’s check, you may be charged a different rate. It could be a fixed fee or a percentage of the entire amount of the check. A bank may refuse to provide a cashier’s check to its customers in some instances.

Counter Check Vs Cashier Check

The bank signs the cashier’s check, whereas the consumer signs the counter checks. The bank issues both cashier checks and counter checks. A cashier’s check is drawn on the bank account, whereas a Counter check is marked on the check writer’s achievement.

How do you obtain counter-checks?

To obtain a counter check, go to your bank or credit union’s branch and make a request. Call ahead to confirm that counter checks are available before going to the branch. Look up how to get the checks and whether you need to go to a specific department.

What is the process of counter-checking?

Counter checks are likely to be printed for you by a teller or personal banker. They have the account information on them. As a result, their work resembles that of regular inspections. In that familiar computerized MICR type, your ABA routing number and account number are shown at the bottom of each check.

What is the cost of a counter-check?

Fees for counter checks vary, but you may expect to pay a few dollars. Chase, for example, charges $2 for each page of three checks. 4

What is the quickest method for receiving checks?

Counter checks could be the quickest approach to obtain checks. You might be able to print them at home if you have the correct printer and paper. Local printing companies might also help if you don’t live near a bank location.

Conclusion

Counter-checking is a helpful tool. From the material we’ve examined, it’s clear that you should be aware that shops do not accept counter checks if you want to pay with an appraisal.

In some cases, even if the correct information is printed about you on the check, it might not be accepted as a form of payment. This is because the counter check has no check number written on it, which indicates to the merchants that they received a counter check.

- Does QT Take Google Pay? - July 1, 2025

- What Are The Most Expensive NFT Ever Sold - July 1, 2025

- WeightRX Review: How to Lose Weight Safely - July 1, 2025