How many pay periods until direct deposit take? It takes one to two pay cycles for a direct deposit to show up in your bank account.

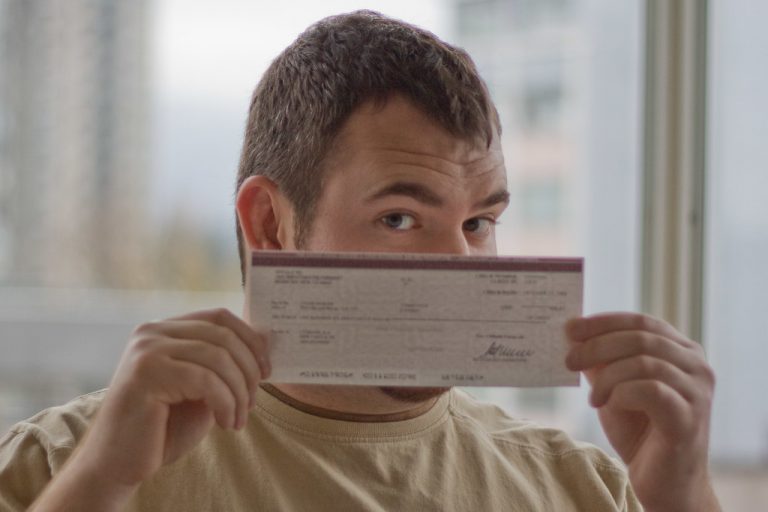

Depending on your employment, you may be given a physical check till everything is in place and ready to go. When it’s ready, the exact time your funds arrive in your account depends on the company you work for and the payroll software they employ.

Why Does My Direct Deposit Take two Pay Periods?

Direct deposit takes 2 Pay Periods because the first pay period will be a trial period to ensure that the account numbers’ information is correct. At that time, you will be given a physical check. Your money will be transferred into the selected account in the second pay month.

Direct deposits are issued to your bank account via ACH up to two days before the scheduled posting date, depending on your payroll company. Most financial institutions keep these monies on deposit until the paycheck is sent, earning interest on them.

How Long Does It Take Payroll To Process Direct Deposit?

On payroll, direct deposit usually takes two or three days. Some direct deposit processing durations are as short as one day (same-day processing), while others might take four days.

The length of time it takes you to process a direct deposit is determined by how you manage it. Before conducting payroll, find out how long direct deposits take to process. Processing timings dictate how far ahead of time you must process payroll to ensure that your employees receive their paychecks on time.

What is payroll processing?

Determining an employee’s salary, withholding taxes, and other deductions, and paying them are all part of payroll processing. Payroll processing, or payroll management, is a task that all organizations with employees must undertake.

You have the following options for processing payroll:

- Calculate by hand.

- Software should be used.

- It should be outsourced

The least expensive but time-consuming approach is to perform manual computations. The most expensive but least time-consuming approach is outsourcing payroll (e.g., hiring a professional employer organization). Payroll software is a good compromise because it streamlines payroll without breaking the bank.

Why Isn’t My Direct Deposit In My Account?

When your direct deposit does not appear as expected, it may simply be because it took a few more days to process. It could be due to holidays or an error in sending the money transfer request after business hours.

Allow at least 24 hours before you begin to be concerned. The money could arrive the next day. During this time, gather all relevant information, such as previous pay stubs, account numbers, and work hours. Put all of your documentation in one easy-to-find location.

How Do I Track My Direct Deposit?

Step 1

Examine the checks that are linked to your direct deposit account. Some banks print their direct deposit tracking number and routing information on the checks they send out. “ACH RT,” which stands for “Automated Clearing House Routing Transit,” is usually plainly identified.

Step 2

Look through your records for any receipts related to the direct deposit. When Signing up for direct deposit, the institution you authorize to deposit your funds may give you a receipt each time a direct deposit transaction occurs. Because it is less expensive, institutions may provide receipts via email. The direct deposit tracking number may be printed on the receipt.

Step 3

Contact the bank where the direct deposit account is held. Request that they supply you with the ACH network’s direct deposit transit number. Banks use this standard number, and your representative will provide you with it.

Step 4

Consult the organization in charge of your direct deposits, such as your company’s payroll department. Instruct the agent to contact your institution’s electronic transaction or direct deposit processing business. Inquire about your direct deposit tracking number from the processing business.

Why Is My Direct Deposit-Taking So Long?

If your direct deposit takes longer than it normally should, the following are some possible reasons.

1. Direct deposits are only processed on business days

Only on working days are direct deposits processed (Monday to Friday). If you make a deposit late on Friday, it won’t be processed until Monday. The deposit will be considerably more delayed if there is a holiday.

Because banks can retain deposits for up to five days before clearing them, the funds may not be accessible for use for up to a week. To ensure that direct payments have enough processing time before the banks and ACH systems close for the holidays, ask payroll managers to submit paychecks well ahead of time.

2. The banks determine it.

Depending on their services, some banks take longer to process direct deposits. Smaller regional banks frequently contract with larger institutions to process direct deposits. Because the process must first reach the recipient’s intended bank and then be outsourced to an intermediary bank to authenticate the deposit, this can cause additional delays.

It is then returned to the recipient’s bank for deposit into their account. To accommodate more customers, larger banks often have faster processing times. They have the cash and technology to quickly and effectively authenticate more intricate transactions.

3. Incorrect information or mismatched details

Banks require that the deposit information match the account name correctly. If there is a little mismatch in these facts, the bank will keep the money for a while before returning it to the starting bank.

Because direct deposits are frequently cleared electronically, it can take a long time for the system to detect an error. A backlog of errors may require a human representative to reconcile.

4. Checks on proxy servers are slow

While three proxy servers are used to evaluate checks and deposits and ensure that they are secure and genuine, finance networks are often slow.

Dedicated servers are necessary for private banking. They improve the client experience by preventing fraud and data overload, requiring less information from senders and recipients, lowering the danger of identity theft, and speeding up the banking process.

5. The ACH system is not used by all banks.

Because the ACH system is electronic, deposits may be scrutinized and validated without human intervention. However, the ACH system is not used by all banks.

All deposits must be manually reviewed and cleared by banks that do not use ACH. Every bank transaction, both sending and receiving, takes a long time to complete. It leads to several lengthy delays in direct deposit receipts. Although most banks in the United States do not do this, it is conceivable at some smaller local institutions.

Conclusion

Direct deposits can take a lengthy time. However, this is primarily due to banks’ attempts to safeguard senders and receivers from fraud. The more time account customers are kept waiting, the more money the banks can make. You must hold your bank account and get your deposits within three to five days.

- How To Sell Unwanted Gift Card For Cash - March 7, 2024

- What Are The Most Expensive NFT Ever Sold - January 31, 2024

- Does Aflac Pay By Check Or Direct Deposit? - January 31, 2024