![How to write a check to yourself - Complete Guide [2022] 2 How to write a check to yourself](https://milvestor.com/wp-content/uploads/2021/11/How-to-write-a-check-to-yourself.jpg)

Learning how to write a check to yourself can come in handy. You might wish to write a check to yourself for a variety of reasons. For example, you’re most likely trying to transfer money from one account to another or withdraw cash from your account. I’ll tell you everything you need to know about writing a check to yourself in this article.

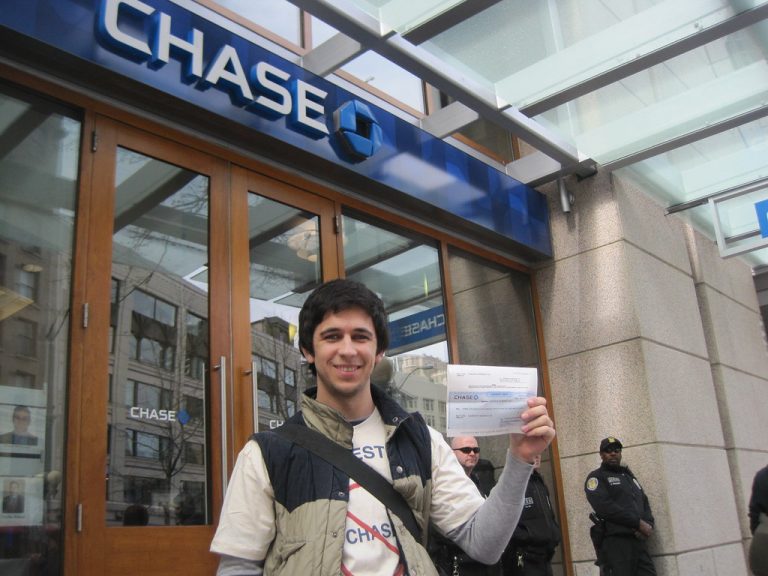

How to write a check to yourself

Just like you write a check to any other account holder, all you have to do is follow the same steps. In the “pay to the order of” area, you write the payee’s name, the amount, and signature. Then, visit your bank and speak with a clerk or staff to obtain the cheque.

Because of checking cards and credit cards, personal checks have become less popular in the age of electronic banking. But unless you don’t have any other options for depositing or withdrawing money, personal checks can still be used.

How to write a cheque to yourself with no money in your account

Follow the steps below to write a cheque to yourself when there are no funds in your account.

- The overall process begins with you receiving a check from the bank.

- You write a check and pay for the services/goods.

- The money comes from the bank and is given to the retailer.

- On the specified date, the amount indicated on the check will be refunded to your account.

Keynote:

Make a personal check and cash it at any bank or check-cashing business. On the other hand, writing a check is the same as writing a check to someone else. This article will be helpful to you if you want to learn how to write a check to yourself.

Should you write a check and don’t have enough money in your checking account, your check will bounce and be returned to the recipient for inadequate funds. When writing a paper check, five stages must be followed.

The breakdown

Electronic transfers have reduced the usage of paper checks, but they are still required on occasion. A check’s preprinted numbers ensure that the cash is delivered to the correct location.

Even though credit cards and checking cards have made personal checks less popular, they are still widely used, especially for paying rent, utilities, and other expenses, as well as for creating a clear paper trail.

Assuming you don’t have any other alternatives, you can use personal checks to withdraw monies from your bank account, and you can cash a check written to yourself at a variety of check cashing locations.

How to write a check to yourself: step by step guide

- Date: Write the date on the check’s blank line in the top right corner. In the United States, the month/day/year format is standard. This is crucial because it tells the bank when you made the check and whether it’s postdated, which means it should be cashed on or after the check’s due date.

- Your name: After the words “Pay to the Order Of,” write the recipient’s name on the blank line. The recipient of the cheque can be an individual, an organization, or a business. If you’re writing about a person, make sure to include their first and last names, and if you’re writing about a company or organization, use the entire name.

- Amount: Fill in the amount in dollars and cents using numbers in the box to the right of the recipient’s name. To avoid someone putting in a new amount, write the amount as close to the left-hand side of the check as feasible.

- Extended version of Desired Amount: Write the dollar amount in expanded word form below the recipient’s name on the vacant line. On the other hand, Cents should be put in fraction form and in small numbers to ensure that the complete amount can be written out, as this is the legally recognized amount on the check.

- Signature: Somewhat on the check’s bottom right corner, sign your name on the line. Your signature is required; otherwise, the check will not be cashed. Before handing over or mailing the check, double-check that you’ve written out your signature.

- Memo: There’s a line on the lower left where you can write your account number for, say, the utility company you’re paying with that check, or you can note what the check is for. It could also mean that the money should be used to pay off your debts rather than something else.

You will be the only person who may deposit or cash this check because it is written in your name. However, if you can assign the check to someone else, there may be an exemption, but that’s another issue.

This cheque should be able to be cashed or deposited at your bank or another bank/institution. Just keep in mind that you might not have immediate access to all of the monies available when cashing a check. It may take several days for you to get all of the earnings.

Why Do People Write a Check?

The transaction policy is one of the reasons why people write checks on themselves. As a result, money isn’t usually destroyed on the same day as it is transferred from one account to another.

You may receive the money after three days, depending on the bank’s policy and other conditions.

Whenever you write a check to yourself, you might get the money the same day or the next. For example, let’s say you have money in your account and would like to pay for the service or product, although you can’t wait for any reason.

Is It Illegal to Write a Check to Your Name?

Rest assured, it is not illegal to write a check to yourself. The only lingering question is how much you can write yourself a check with no repercussions. Then, begin a transaction from one bank to another, using separate accounts in your name.

Your bank pays the amount to the payee, but you must refund the entire amount from your account. You will be charged if you cannot secure it because you lack the necessary cash despite having an account.

Check to kite is when you write a check knowing you don’t have any money in your account. It’s a deception that allows people to take advantage of the system and gain access to resources that would otherwise be unavailable.

What is Check to Cash?

The word “Cash” appears on the cheque payable to cash, where you ordinarily write the payee’s name. A check payable to cash is not payable to a specific person or organization; anybody who has the check can cash or deposit it.

The majority of checks can be made payable to someone, and the person who will receive the funds is also specified when the checks are written. The only person who is allowed to handle or deposit the check is the payee. Instead of the payee’s name, you should write “Cash” on this sort of check.

Why would anyone write a check to themselves?

There are various sorts of checks, but the concept is the same. In most circumstances, the bank must first confirm that the check’s amount is accessible on the account holder’s balance.

This is how cashier’s, private, and certified checks work. The difference is that the funds in the latter circumstance are frozen but remain part of the account holder’s balance. Thus, checks are an alternative to electronically transferring funds from one account to another.

There is no way to reverse the process after the payee withdraws money from a bank, ATM, cashier, or other location. However, fines may apply if there is no balance on the indicated account on the due date.

Keynote:

A check written to yourself has the same effect as a check written to another bank account. In the “Pay after order” area, you write the payee’s name, input the amount, and sign it.

You can acquire the check by going to your bank and speaking with a customer service representative or a clerk. But, of course, you won’t be able to buy an infinite amount of checks. In addition, because each bank has its policies.

Write yourself a check and transfer the money to your other account when moving money between banks, such as transferring or adding money to an online bank account.

However, keep in mind that there may be simpler ways to transfer. The cheque can be deposited in several ways

Alternative methods of getting your cash

Suppose you don’t want to transfer money to a new bank account and spend some money. It’s possible that you won’t even have to write a check. There are a few options that are potentially easier and don’t require the use of any cheques:

1. P2P transfers

Several institutions offer P2P transfers as a way to speed up the transfer procedure. These transactions have some restrictions, but they are rather generous and even allow transfers across corporate accounts. For example, your receiver would need to create a Zelle account, which takes only a few minutes and is a very simple process.

Setting up an account with these services isn’t difficult. All you need is an email address and your routing and account numbers. You’ll be able to transfer and receive money between banks once you’ve linked your bank accounts.

2. Wire transfer

A wire transfer is also an option for transferring funds to another account. However, there are always fees associated with wire transfers. Transaction fees can be rather exorbitant at times, and a simple wire transfer might easily cost you more than $20. Premium accounts, such as Chase Private Client, allow for free wire transfers.

3. Business account

You can write a check to yourself from your business account if you are a small business owner like me. The most important criterion is that you have the authority to sign a check drawn on your company’s account.

You should have established up who has this authority when you set up your bank account, and if you run a small business on your own, you probably already did.

Bear in mind that co-mingling funds is not a smart idea, so if you do this, make sure to document everything thoroughly in case something goes wrong later.

Conclusion

Writing a cheque to yourself is easier when you know how to. I hope this guide makes the overall steps easier for you. Feel free to drop any contribution you might have in the comments section.