The best way to check if a credit card is active is by quickly scanning the status of your credit card on your app or online banking portal if you have an online banking account. You can also check the status of your card by calling the customer service hotline. If you’re shopping online, try using your card to see if you can complete the transaction.

Your credit card must be open, active, and in good standing to be used for purchases and other transactions. In certain instances, your credit card may become inactive and hence unusable.

There are several ways to determine whether a credit card is active or not.

Visit the issuing bank, check the credit card statement, and so on for other convenient ways to check the status of a credit card. A card can become inactive in several ways. If you haven’t used your credit card in several months or years, it may be deactivated by the credit card company.

Your purchase privileges may be suspended if you become behind on your payments. When a credit card expires without a new card, it might become inactive.

Keynote

It will be rejected when you try to use an inactive credit card. Check to see if it is active before using it to save yourself some embarrassment and the effort of finding a backup payment option.

How To Check If A Credit Card Is Active

1. Visit the Bank in Person

When you wish to speak with a bank representative in person, go to the bank that issued your credit card and speak with the bank representative. You can also go to a local branch of your credit card issuing bank.

When visiting the branch, make sure to bring your valid photo ID card and credit card. Before you can ask the banker to check the status of your credit card, the banker will verify your identity.

2. Customer Service should be contacted

If you are unsure about the internet or online banking, you can call customer support to inquire about the status of your credit card. Most banks offer 24-hour customer assistance, allowing you to check your credit card balance at any time. You are free to phone customer service and ask for the information directly.

When you call customer care, the person will verify your identity by asking for your credit card number, security code, date of birth, national identity card number, and other information. You can learn anything about your credit card, including whether it is active or inactive, once your identification has been validated.

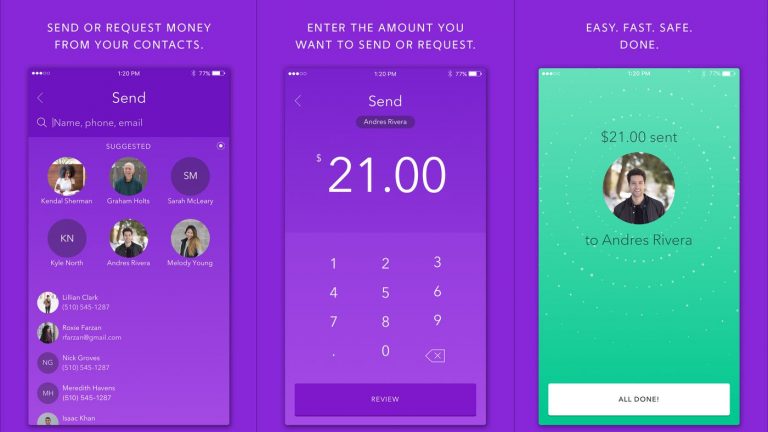

3. Look into Online Banking.

You can quickly check the status of your credit card if you have an online banking account. Because you can also check your credit card limit, balance, and other crucial information, this is the most convenient approach to see if a credit card is active or not.

You may check the status of your credit card on your computer, laptop, or smartphone. It gets easy to check your credit card online if your card issuer bank offers a mobile app.

4. Examine Your Credit Card Statement

A credit card statement is sent to you once a month and contains a lot of information about your credit card. The credit card statement can readily tell you if your card is active or not.

If your credit card is closed for any reason, your credit card statement will appear on your credit report. The report, however, will not reveal why your card is restricted, suspended, or inactive. To find out why your card is fixed, you must contact the financial authority.

5. Check The Registered Email For Notifications

You must enter a valid email address to receive card statements and other notifications when applying for a credit card. As a result, you can quickly determine whether your card is active or not by looking at the email notifications.

The bank will generally give you a monthly report or billing statement by email, and if there is a problem with your card, the bank will also send you an email about the issue. As a result, you should check your email frequently.

6. Make A Small Payment

If the following three techniques do not satisfy you and you want to test your credit card, the best thing you can do is make a little online or offline payment. As a result, you can use your credit card to check whether it is active or not. If your payment has been processed, your card is active.

However, if your payment is denied, it means there is an issue with your credit card, and your card may be no longer active. If you receive a notification indicating a failed transaction, the following are the three most typical causes:

How To Activate an In-Active Credit Card

You’ll need to call the customer service number on the back of your credit card or find it on the bank’s website if you don’t have the card with you. You can also activate your credit card by visiting a branch in person.

If you don’t activate your credit card within a few weeks of receiving it in the mail, your bank may cancel it. Many issuers will send multiple reminder letters before canceling a card that remains inactive.

You can use a credit card that hasn’t been activated yet if you’re making an in-person purchase at a store or restaurant. However, you can’t make online or phone purchases with a credit card that hasn’t been activated yet.

In most cases, you’ll be asked to provide the whole account number and security code from your new credit card when activating it by phone or online. If you’re starting the card in-person at a branch location, you may need to show identification and provide personal information to prove ownership of the account.

How To Keep Your Credit Card Active

There are numerous methods for keeping your credit card active while remaining stress-free. They are:

- That should pay your credit card bill on time to create your credit card company’s reliability.

- To ensure that your credit card is paid on time, you can set up automatic monthly bank payments.

- If possible, pay off the entire credit card debt because this will lower your credit utilization rate and keep your card active.

- Loans have an impact on credit card standing because defaulting on other loans lowers your credit score, and a low credit score may force the credit business to revoke your card.

- Ensure you agree to the new terms and conditions if the card issuer’s company/bank changes them.

- When you have two or more credit cards, make sure you rotate them and use each one.

What To Do If Your Credit Card Isn’t Working

Many deactivated credit cards can be revived simply by contacting the credit card company and requesting it. Before you use your card again, you may need to make up any missed payments.

You possibly won’t be able to open it again if it’s shut, especially if it was closed due to a crime. You’ll need to know how much you can top up once you’ve confirmed that your credit card is still functioning.

Before making any purchases, check your account or ask the issuer for your current amount and available funds. You may rest assured that you will not exceed your credit limit this way.

Keynote

Even if your credit card is no longer active, you are still responsible for making minimum payments on your balance. Overdraft charges and damage to your creditworthiness can occur if you do not make your credit card payments on time.

In today’s world, credit cards have become a necessary tool. They can be used to make purchases you don’t have the funds for or purchase something from a distant seller without waiting for a physical check to arrive. Consider the pros and cons before deciding whether or not you need a credit card.

What happens when a credit card is closed due to inactivity?

It is possible that closing a credit card due to inactivity will harm your credit score. If you don’t use your credit card, the card company won’t profit from merchant transaction fees or your card interest. As a result, keeping your credit card account active is pointless.

Is it possible to reopen my credit card once it has been closed?

The credit card issuer determines whether or not you can reactivate a closed credit card. Furthermore, the reasons for canceling the credit card are crucial. As a result, there’s no guarantee that you’ll be able to reopen a closed credit card.

How long does it take for your credit card to become inactive before it is closed?

There is no set time restriction for inactivity, and it is primarily determined by the Credit Card Issuer Company or bank. If you do not use your credit card for an extended period, it will become inactive. And, if the card is passive for an extended period, the credit card provider will cancel the account.

Conclusion

This is where the curtains are drawn. It’s easy to fall into a vicious cycle of credit card debt, and it’s even harder to pull out of. Everything is avoidable if you don’t charge more than you can afford and pay on time.

In such an emergency, credit cards come in handy. Shopkeepers, too, like to be paid with a credit card. This is due to the ease with which cashless transactions can be completed. However, to use your credit card, you must first validate it.

- [EXPLAINED] What Stores Can I Load My PayPal Card - July 4, 2025

- Does Circle K Take Google Pay? - July 4, 2025

- 7 Best Gaming Gift Cards Online - July 4, 2025

![How To Check If A Credit Card Is Active [6 Proven Ways] 1 How To Check If A Credit Card Is Active](https://milvestor.com/wp-content/uploads/2022/03/How-To-Check-If-A-Credit-Card-Is-Active-3-1024x828.jpg)

2 Replies to “How To Check If A Credit Card Is Active…”