Burlington, previously known as Burlington Coat Factory, is a nationwide off-price department store retailer based in Burlington Township, New Jersey, and a branch of Burlington Coat Factory Warehouse Corporation, with 740 shops in 40 states and Puerto Rico.

Burlington shops are often found in great urban locations where increased foot traffic is nearly assured.

The benefits and drawbacks of the Burlington credit card from Burlington and Comenity Bank are detailed in this Burlington credit card review. You’ll learn about the card’s rewards and features, as well as the fees and credit scores that are recommended.

Burlington cards are available from Comenity Bank, a co-branding Burlington coat factory. The card is designed for people who shop at Burlington frequently. The good news is that Burlington now sells products online as well. So you can also use this card to shop for clothing, shoes, and other items online.

You can also log in to your card account or learn how to apply for the card online. You can leave your feedback on this credit card at the bottom of this page. Burlington cards are available from Comenity Bank, a co-branding Burlington coat factory.

Highlights of this Burlington credit card review:

These are the main details you need to know about the Burlington credit card. They include:

- There is a four-dollar annual cost;

- There are no incentives;

- You have a thirty-day return policy.

- There are no available balance transfers;

- It is not possible to get a cash loan.

The card is designed for people who shop at Burlington frequently. The good news is that Burlington now sells products online as well. You can also use this card to shop for clothing, shoes, and other items online. Without any further delay, let’s step right into the Burlington credit card review.

Burlington Credit Card Review

Burlington gives its loyal customers a credit card to help them finance coats, men’s clothing, and women’s fashion accessories across the country. Burlington Bank, which used to be known as the Burlington Coat Factory, issues the Burlington card.

You’ll also receive a 10% discount on your first order with this credit card. That discount, however, comes with a catch: you must use this credit card for the transaction on the same day you activate it. This will squander your deal otherwise.

Why should you choose Burlington?

You’ll get excellent values every time you buy at Burlington. Doesn’t it feel wonderful to get great deals?! But, because of who we are as a business, you can also feel good about purchasing at Burlington.

How to get Burlington Credit Card

To have access to Burlington credit card, you must first apply, and if you meet the standard requirement by this company, you’ll be able to use their credit card for your transactions, bill payments, etc.

However, we suggest a credit score of 630 or above if you want to apply, as this will increase your chances of approval.

To apply for the Burlington credit card program, you must complete the following steps:

- You must be of legal drinking age in your state or area.

- Have a valid tax identification number issued by the government (such as an SSN or SIN)

- Have a street address, a rural route, or an APO/FPO address (no P.O. Box addresses)

- Have a current government-issued picture ID.

- Pay a visit to any Burlington Store.

- Click here to apply online.

Although an email address is not necessary to apply, it is essential to use the Burlington loyalty program’s privileges.

Once approved, you will get your new Burlington credit card within 7–10 business days.

How to pay bills with Burlington Credit Card

You may pay your account in several ways, including online at www.burlington.com/mycard using your phone.

For further information, please refer to your billing statement.

You’ll find the necessary payment details in your Credit Card Agreement and your billing statement.

You may also use your online banking website to settle your Burlington credit card account debt.

You may find your Burlington account number on your Burlington credit card, and your billing statement will provide the payment address, enabling you to make payments via your bank. Please wait five business days for the amount to be processed.

Features of the Burlington credit card

1. Online card management is simple: It is usually challenging to keep track of your statements and invoices when using a credit card. On the other hand, the Burlington card has the advantage of managing the card online. That is to say, whether you want to keep track of costs or pay your credit card account, you may do so online.

2. Reward program on offer: The Burlington credit card’s reward program is one of its most appealing features. You will receive one point for every dollar spent at the Burlington Coat Factory shops. It indicates that you will get the most out of your money if you use this card. It’s one of the card’s key attractions.

3. No annual fee: In this Burlington credit card review, third on our list is their yearly fee. Having a Burlington credit card has no negative aspects. This is because there will be no annual fees to pay. It means that, even if you use it sometimes, it will become inexpensive to own such a card because you will not be charged any further fees.

4. Returns without a receipt: A Burlington credit card has no disadvantages. This is because you will not be required to pay an annual fee. It means that even if you only use it sometimes, owning such a card will become simple because you will not have to pay anything more for it.

5. Alerts for early-bird deals: You can save a lot of money if you use this card to shop at Burlington stores. You can, for example, have first access to a variety of specials and offers. In addition, it signifies there’s no chance the item will run out of stock before you buy it.

6. Easy to pay: Finally, on our Burlington credit card review, you can check the amount you’ve spent and make a payment via the company’s official website. You won’t have to worry about going through a long process to pay your bills because you can pay them online.

What are the credit card benefits?

- At Burlington, MJM, and Cohoes store locations, cardholders get 1 point for every $1 spent on their Burlington credit card.

- They will also receive a new cardholder discount offer for same-day use (offer varies by location).

- Cardholders are automatically registered in the Burlington reward program, whether their Burlington card application is approved.

- Loyalty members will receive exclusive email updates regarding shipping offers, new arrivals, and fresh markdowns if they give an email address.

Who Should Get the Card?

We aim to make you fully informed with this Burlington credit card review. For those who want to shop at Burlington Coat Factory, the Coat Factory credit card is a good option.

However, if you’re going to shop for clothing and accessories in different stores and don’t plan on making several purchases at the Burlington stores, you might not need it. Before applying for a credit card, keep in mind that the card does not benefit and that the interest rates may be relatively high.

Burlington Credit Card Application

Follow these steps to apply for your credit card:

- First of all, click here to enter their website.

- Click the Signup button after you’ve arrived at the page.

- Please include the following information: (Personal Details, Contact Details, Residential Details, and Financial Details)

- You’ll also have to provide information like your company name (if relevant), city, contact name, contact phone number, state, email address, country, and so on.

- To finish your application, press the “Send” button.

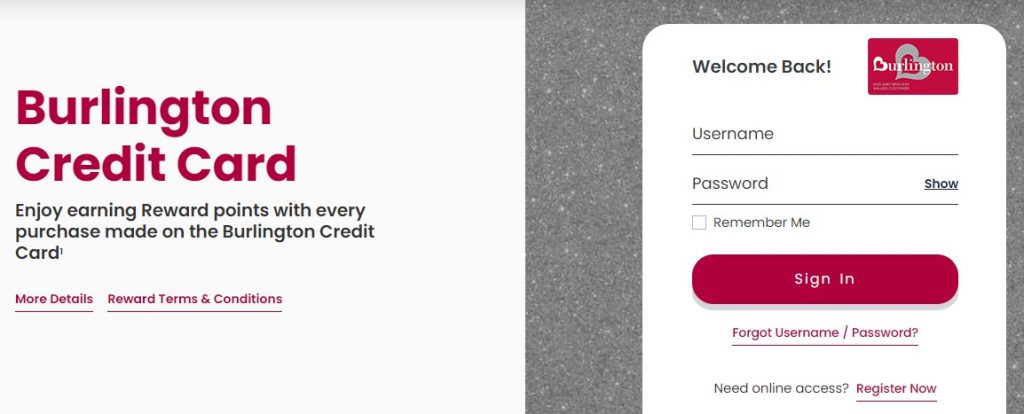

Burlington Credit Card Login

Next on our Burlington credit card review is the login process.

You can quickly check in to your credit card account online at any time if you already have this credit card and have signed up for online access. As a result, you’ll be able to check your balance or make an online payment using your card.

You can now login into your Burlington store card account by following the steps outlined below.

- Click this link to access the login page.

- The Burlington credit card login form may be found on the left, and this is where you can immediately sign in to your account.

- Start by typing your username in the first field, then, in the following area, type your password.

- If you tick the box next to “Remember Me,” your username will be saved. This is particularly important because it will help you log in faster in future sessions.

- When you’re finished, click the “Sign In” button to complete the login process.

- You’ve followed all of the steps correctly; you’ll be able to log into your card account immediately away. You may now manage your credit card account online in whatever way you like.

Burlington Credit Card Payment – How To Pay

This Burlington credit card review will not be complete without showing you how to pay for your card.

You may pay your Burlington store card in three ways right now: online, over the phone, or through the mail. Unfortunately, you can’t pay with your card in a store right now. So we’ll show you how to spend your Burlington credit card in each of these methods right now.

Naturally, paying for this card online is the most convenient option. To do so, complete the instructions in the preceding section and log into your card account online. You’ll be able to pay right away from there.

Benefits of Burlington Credit Card

At Burlington, MJM, and Cohoes retail locations, cardholders get 1 point for every $1 spent on their Burlington credit card. They will also get a new-cardholder discount offer for same-day usage (offer varies by location).

Cardholders are automatically registered in the Burlington reward program whether their Burlington credit card application is accepted.

Loyalty members will get special email updates regarding shipping deals, new arrivals, and fresh markdowns if they give an email address.

With your Burlington Credit Card, you will get one point for every $1 spent on Burlington items.

- For every 100 points earned, you will get $5 in rewards.

- For every 500 points earned, you will get a $25 reward.

- For every 1000 points earned, you will get a $50 reward.

- For every 2000 points earned, you will get a $100 reward.

Is the Burlington credit card good?

The Burlington Credit Card is a great option (or above) if you have fair credit.

Their Annual Percentage Rate (APR) is relatively high (above 20 percent).

If you want to apply, you need to have a credit score of at least 630.

FAQs about Burlington Credit Card

Is there an app for Burlington?

With the free Burlington Connected smartphone app, you can easily submit service requests on the move.

The program, available on all platforms, employs GPS integration to pinpoint the reported problem’s location instantly.

Burlington accepts what kind of payments?

The Burlington online store accepts the following credit cards: AMEX, Euro/Mastercard, and Visa. All of your data is sent through an encrypted SSL connection to secure your credit card information, preventing unauthorized access.

Can I use my Burlington card anywhere?

A shop card co-branded with a network such as Visa or Mastercard is an exception. When you use the card, you’ll still be eligible for any in-store discounts, and you’ll be able to use it everywhere the card’s network is accepted.

What is the minimum score required for a Burlington card?

A credit score of 630 or above is required for a Burlington Credit Card. This indicates that persons with at least fair credit may be eligible for this card.

Who is responsible for issuing Burlington card?

Comenity Capital Bank is the issuer of Burlington Credit Card Accounts.

Burlington is located in how many states?

I’m glad you inquired. In the United States, there are 27 Burlington (28 if you count Burlington city and town as two different things).

Burlington, NC, is the most populated Burlington, with over 50,000 residents.

What states can you find Burlington in?

Burlington is available in Canada, England, and especially in the United States. Below are the different states you can easily find in Burlington.

Canada

- Newfoundland and Labrador’s Burlington

- Burlington, New Brunswick

- The most populated city with the name “Burlington” is Burlington, Ontario.

- Prince Edward Island’s Burlington

- Burlington Bay, currently known as Hamilton Harbour, is located in the province of

- Ontario, Canada.

- Electoral districts on Burlington Street (Hamilton, Ontario), an expressway/arterial road

- Burlington (electoral district), in Ontario, Canada, is a federal electoral constituency.

- Burlington (provincial electoral district) is a Canadian provincial electoral district located in the province of Ontario.

- Provincial electoral district in Ontario, Canada was Burlington South.

England

- Bridlington, once known as “Burlington,” is a town in Yorkshire.

- Burlington is a tiny hamlet in East Shropshire near Telford, located along the A5.

- Mayfair, London, UK, Burlington Estate

- Burlington House located in Mayfair, London, United Kingdom.

United States of America

- California

- Colorado

- Connecticut

- Illinois

- Indiana

- Lowa

- Kansas

- Kentucky

- Maine

- Massachusetts

- Michigan

- New Jersey

- New York

- North Carolina

- North Dakota

- Fulton County, Ohio

- Oklahoma

- Linn County, Oregon

- Multnomah County, Oregon

- Pennsylvania

- Texas

- Nashville, Tennessee

- Vermont

- Barboursville, Virginia

- Petersburg, Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

- New Jersey

- South Burlington

Where can I use my Burlington credit card?

Unfortunately, this credit card is not affiliated with a significant payment network like MasterCard or Visa. As a result, this credit card can only be used in Burlington. The card is also valid in Burlington Coat Factory’s Cohoes and MJM stores.

How to pay Burlington credit card online?

In truth, paying your Burlington Coat Factory credit card online is simple. Follow the instructions in the “Login” section of this page to accomplish this. You will be able to make a payment immediately after logging into your credit card account online.

How to get a Burlington credit card?

You must fill out and submit an application form to acquire this credit card. This credit card will be mailed to you once you have been accepted.

What bank does Burlington credit card use?

Burlington coat retailers use Comenity Bank as their bank. It is unquestionably a trustworthy institution. As a result, you have nothing to worry about when using this card.

How do you redeem Burlington rewards?

The prizes can be redeemed in several different ways. You can do so with cash or with PayPal. First, input the rewards code on the website if you wish to do it online. Then, use the reward points to make a purchase.

Burlington credit card review: Conclusion

This wraps up our Burlington credit card review. The Burlington credit card is an excellent choice if you shop at Burlington frequently. You can undoubtedly enjoy several perks and save money thanks to the awards you receive and the advance alerts.

Are you on the fence about the Burlington credit card? Then, we urge you to take the plunge. Burlington Bank offers various credit and debit cards to choose from based on your interests. We hope this Burlington credit card review has been of help. Do you have any suggestions or requests? Let us know in the comment section.

- How To Sell Unwanted Gift Card For Cash - March 7, 2024

- The Complete Guide to Crypto Arbitrage - February 10, 2024

- What Time Does ADP Direct Deposit Post? - February 10, 2024

One Reply to “Burlington Credit Card Review | Is This Good for…”