When it comes to making discrete payments online, virtual cards can be quite useful. If you need to make transactions on onlyfans, using virtual cards is one of the best options for staying anonymous.

Today, I will be exploring a list of the best virtual credit cards for onlyfans. and you can hide your onlyfans transaction by using different onlyfans payment methods.

This list will be incredibly useful to you and come in handy in countless instances. Let’s take a look.

Best virtual credit cards for onlyfans

- Payoneer

- US Unlocked

- Stripe

- Card.com

- Blur

- EcoPayz

- LeoPay

- Walmart MoneyCard

- Netspend

- American Express

10 Best virtual credit cards for onlyfans

1. Payoneer

Payoneer’s virtual card enables you to make purchases online in MasterCard-accepting online stores. Using Payoneer’s virtual card to make payments is similar to using a physical card. You only need to submit your credit card information on a payment page.

The Payoneer card is perfect for making discrete payments and you don’t have to worry about Onlyfans transaction showing up on your bank statement when you use the Payoneer card to complete your only fans payment.

You can signup for a Payoneer account, and get a virtual card. You must fill out the essential information on Payoneer’s website. The provider will then review your details before handing you a virtual credit or debit card.

Best features:

- For internet purchases that are made quickly

- its best for discrete payments

- The application is simple.

- It is acceptable in MasterCard-accepting establishments.

- With a Payoneer account, it’s completely free.

Conclusion: If you have a Payoneer account, you will greatly profit from its virtual card service. It is simple to apply for and allows for speedy internet purchases. These cards are suitable for making a one-time purchase of an online service.

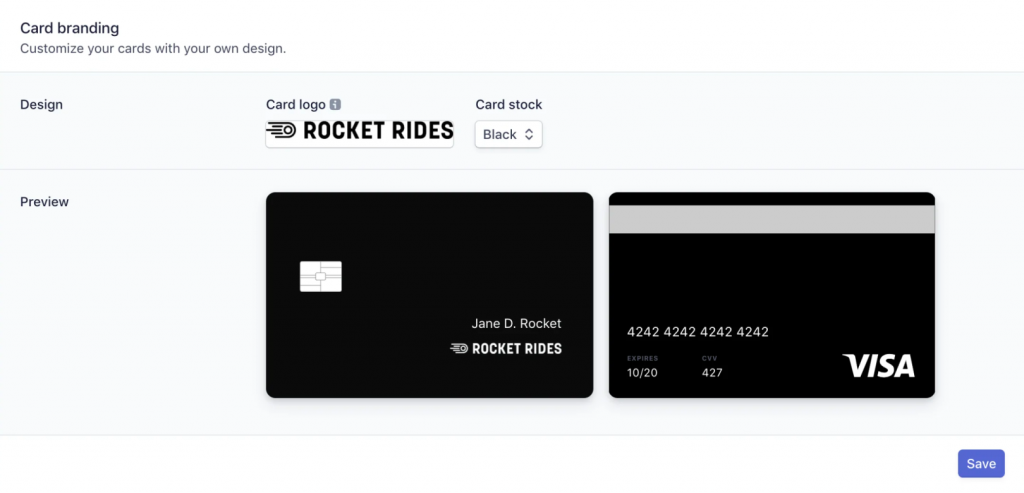

1. Stripe

This is one of the best options to consider when you plan to use onlyfans. Stripe allows you to generate as many virtual and actual cards as you desire. Businesses that need to manage payments to clients and/or staff may find this tool very useful.

Stripe provides a wide range of financial services, administration, automation, and payment solutions, and is also gaining traction in the virtual card space.

Best features:

- Setup is simple and quick, and cards are created instantly.

- Types of businesses and industries are restricted.

- virtual cards with a single or numerous use

- unique expenditure limits

- in every charge, make real-time judgments

As for the pricing, Virtual cards are $10 each, whereas actual cards are $3 each. For the first $500,000 in credit card transactions, there are no costs.

2. Card.com

When it comes to generating a virtual credit card for venture onlyfans and other uses, Card.com is a wonderful place to start. There are no credit checks required, and there are no hidden costs. For a more personalized design, you can add a selection of graphics and photos to your card.

Best features:

- From anywhere in the world, you can pay, shop, and receive money.

- Smoothly integrate with your American bank.

- There are no hidden costs.

- There will be no credit checks.

Conclusion: If appearances are important to you, you’ll love receiving a custom-made virtual card from Card.com. Without any fees or credit checks, you can start using your virtual card right away. As soon as this brilliant service issues you with a virtual prepaid card, you may begin enjoying a hassle-free online purchasing experience.

You can either choose a card design from their large gallery of alternatives or specify your preferences to have a card designed to your exact specifications. The early direct deposit function of the virtual card service allows users to get paid up to two days early.

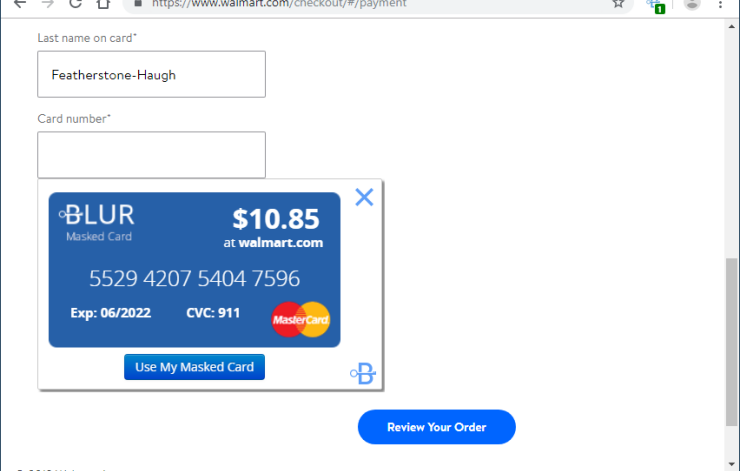

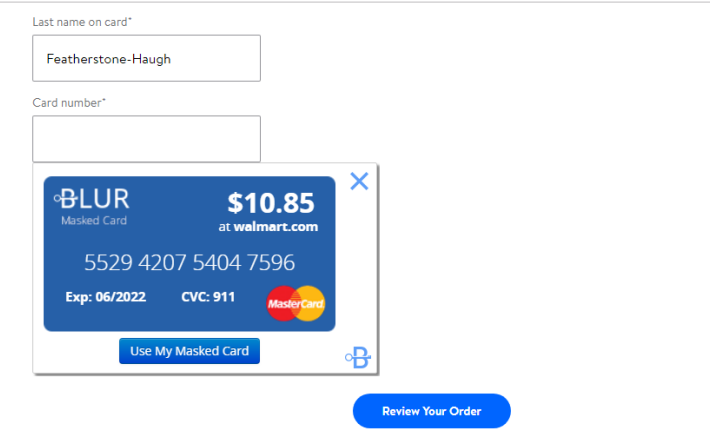

3. Blur

As an exclusively fans user, you will be able to take advantage of the most secure password-protected online transactions available. The high level of protection that Blur’s virtual credit card services offer to bank transactions or internet payments makes them popular.

It connects to a variety of devices, allowing you to pay and check out using your phone, tablet, or browser. Every time you make a transaction, you can generate a new credit card number. Its security is perhaps the most attractive characteristic.

The software can encrypt your password, making it nearly hard for hackers to steal vital data or bank account information.

Best features:

- Making payments and bank transactions as simple as possible

- Each payment should generate a new VCC number.

- All gadgets are compatible.

- Passwords are encrypted.

Conclusion: If you’re looking for a VCC that lets you conduct secure online transactions, Blur should be on your radar. To protect yourself from phishing and other nefarious tactics, you can rapidly generate new credit card numbers.

4. EcoPayz

EcoPayz is an all-in-one virtual payment system that allows customers to send and receive money from anywhere in the world using a single, secure online platform. To open an account with EcoPayz, you don’t need a bank account or a credit check.

After you’ve set up your account, you’ll have access to your funds through this platform, which you can spend in any way you like. The tool is also equipped with the most up-to-date fraud protection technologies, ensuring that your money is protected while making online purchases.

When using EcoPayz’s virtual card to conduct transactions with merchants, partners, or online retailers, it is safe, secure, and efficient

Best features:

- Money can be sent and received from anywhere on the planet.

- Manage all of your assets from a single location.

- It’s simple to set up, there’s no need for a bank account, and no credit checks are required.

- Robust security protocols

Conclusion: EcoPayz is a secure platform for managing your funds and conducting financial transactions for both personal and business purposes all over the world. When opening an account with EcoPayz, there is no requirement for a bank account or a credit check, earning it a coveted spot on this list.

5. LeoPay

LeoPay is a global financial management solution that allows customers to create an account in minutes and obtain several IBANs (International Banking Account Numbers) in various currencies.

It’s simple to set up and use, and it’s accessible via the web or a mobile app. Users get two virtual cards for free when they sign up for the program. The card can be used to pay or withdraw money from any location on the planet. You’ll also receive transaction alerts for any payments you make or receive right away.

Best features:

- Obtain numerous IBANs in more than ten different currencies.

- Two complimentary visa cards are available.

- Notification is received immediately.

- Web and mobile app access are available 24 hours a day, 7 days a week.

Conclusion: LeoPay is designed for frequent travelers and enterprises with operations in multiple countries throughout the world. With the virtual Leo visa card, you can pay and withdraw money from anywhere in the world.

6. Walmart MoneyCard

Walmart MoneyCard is a full-service virtual financial system that, in essence, manages your banking needs through a strong digital ecosystem. You may load money onto your Walmart MoneyCard instantaneously from any bank in the United States.

This money can be put towards making online purchases a breeze. You may now deposit cash for free at any Walmart store across the country using the MoneyCard app. Within the MoneyCard app, you can add up to four more virtual debit card accounts, as long as they are all over the age of 13.

Best features:

- Cash reloads for free

- Money can be added from any bank account.

- Save money and earn 2% interest.

- Create a family virtual debit card account for four more people.

As you may have noticed, Walmart MoneyCard is a robust virtual payment system/app that streamlines your financial management. You can contribute money to your account, receive a better interest rate on your savings, make purchases, and much more using the app on your phone.

7. Netspend

Netspend is a fantastic online financial management solution. It achieves so by giving customers a virtual prepaid card that they may personalize with a photo or symbol of their choice.

When creating a temporary card number to use on sites that don’t accept debit cards, the service comes in handy. The card can be used anywhere in the country and protects your physical debit and credit card details.

You can also check your balance at any time and from anywhere. With Netspend’s virtual credit cards, receiving transaction alerts as SMS messages is also quite convenient.

Best features:

- Transactions can be made from anywhere and anytime

- While on the move, you can check your balance

- Use for a limited time

- It’s completely customizable.

Conclusion: When trying to access a site that doesn’t take a standard debit card, Netspend’s virtual card should come in handy. It lets users receive real-time updates on transactions and account balances from any location on the planet.

8. American Express

You’re well aware of how difficult it is for a freelancer to obtain a credit card. American Express recognizes this and offers its customers a virtual credit card service that is both simple to use and administer.

This virtual card can be used to make online purchases by self-employed professionals such as freelancers, digital marketers, and writers. With this VCC, keeping track of all your transactions is a breeze.

You can also set spending limits on the card, which helps you figure out how much you’ll be charged.

Best features:

- Simple to use

- Keep track of your transactions.

- Control your spending

- Make payments with your phone.

Conclusion: American Express offers a virtual credit card solution that is tailored to the needs of independent contractors. It’s simple to use, useful for tracking transactions and enables smooth payments with preset spending restrictions.

9. 7The US Unlocked

This virtual prepaid card is most recognized for allowing users to shop from a range of US shops from any location in the world. It just took a few minutes to sign up for their service, load $50 onto the card, and pay a nominal charge to use the card for one-time transactions at a variety of US shops.

US Unlocked offers two types of cards. The first card is only good for one transaction and cannot be used again. The other is a merchant-specific card, which becomes locked to a specific merchant following a transaction with them.

Best features:

- Billing and shipping addresses in the United States have been assigned.

- Limit your spending.

- Websites that are only available in the United States

- Connects you with freight forwarding companies.

The US Unlocked provides you with a valuable virtual card that allows you to easily visit any of your favorite US-specific websites. It only requires a simple sign-up and a little monthly charge that is based on the amount loaded on your card. With the cards you receive from US Unlocked, shopping online is a breeze.

Benefits of virtual debit/credit cards

1. Spending management and more security

In most cases, you can specify a limit charge amount and have the card expire on a specific date. Several virtual cards will also lock to a merchant, preventing the card from being used elsewhere if the merchant suffers a security breach.

Even if someone manages to obtain your virtual card information, they’ll be restricted to the amount you’ve specified as the maximum. Furthermore, you can use these limitations to limit the amount of money you spend on one-time or recurring payments, which are frequently done with digital wallets. Control your revenue like you would your expenses.

2. As a company, you should cut costs anywhere you can.

You will be able to save money on processing and strengthen internal controls as a business. Producing and mailing virtual cards is less expensive than sending money. With a speedier and more efficient payment solution that can’t be hacked, you’ll be able to eliminate paper-based payments.

Virtual cards save time, and your digital cards and wallets can be used anywhere. Virtual cards are accepted by virtually any vendor or business that accepts debit or credit card payments.

3. Increased security

In most cases, you can specify a limit charge amount and have the card expire on a specific date. Some virtual cards will also lock to a merchant, preventing the card from being used elsewhere if the merchant suffers a security breach.

Even if someone manages to obtain your virtual card information, they’ll be restricted to the amount you’ve specified as the maximum. Furthermore, you can use these limitations to limit the amount of money you spend on one-time or recurring payments, which are frequently done with digital wallets. Control your revenue like you would your expenses.

Conclusion

Choosing the best virtual card for onlyfans no longer has to be a chore. I hope you find this list to be beneficial. There are simply too many compelling reasons to choose a virtual credit or debit card over a physical credit or debit card. It is not only exceedingly convenient but also extremely safe and dependable.

If you have the correct virtual card, you can shop virtually anywhere on the globe. It’s also a must-have for freelancers and independent contractors who find it difficult to obtain a traditional credit card from a bank.

- Does Dunkin Take Google Pay And Apple Pay? - July 5, 2025

- Tips to Help Minimize the Financial Burden of Owning a Car - July 5, 2025

- Does Walgreens Take Google Pay? - July 5, 2025

One Reply to “10 Best Virtual Credit Cards For Onlyfans”