Imagine being able to plan, save and invest your money at a go, all from one location. With Cowrywise, you are offered this and more. After experiencing their services first hand, this Cowrywise review should help you evaluate the positive and negative aspects of this platform.

What is CowryWise? – Cowrywise Review

Cowrywise was founded in 2017 by Razaq Ahmed and Edward Popoola.

Just like PiggyVest, Cowrywise is a digital solution that helps its customers effectively cultivate helpful financial habits. This financial habit entails allowing them to save and invest on the platform.

While saving requires a lot of disciples, finding the right legitimate investment opportunities can also be quite a hassle. Cowrywise allows its users to “kill two birds with one stone” by providing these two services.

A fintech company at birth, Cowrywise was first established in the year 2017, in July. With its top-notch asset management protocols, Cowrywise has been able to easily process customers deposits on savings and investments.

With the aid of their automated savings feature, users can easily simplify their savings. They have also partnered with various investment platforms in the class or money market and mutual funds. This is done to make more opportunities available.

With their interests, you can earn on your savings even while you make profitable investments. Let’s take a deeper look into this Cowrywise review.

Cowrywise Saving Plans – Cowrywise Review

In this section, of our Cowrywise review, we will address the different types of saving plans available to its customers. With as little as N100, you can begin your savings journey.

Cowrywise aims to make saving as convenient as possible, this requires them to have flexible plans that meet the need of customers.

The best way to take advantage of the platform is to evaluate the different plans available. This should help you decide on the option that suits you best.

1) Regular Savings

Saving doesn’t have to be a complicated activity. With the right platform, you can have a seamless saving experience. This is the basic savings plan offered by Cowrywise. With this savings plan, you can take advantage of their autosave feature.

This will allow you to automate your savings without having to be involved. You can freely decide on your savings interval, whether you want it to be carried out daily, weekly or monthly. The minimum saving duration on this plan is 3 months.

2) Savings Circle

Communal saving has always been a part of our life from time past. This plan allows groups of friends, family or associations to reach their financial goals. With Cowrywise, this saving style has been digitalized. With a digital version of this saving style, customers and users can enjoy an improved version.

As a group, you can make saving targets while saving together towards a common target. This communal saving plan allows you to build a spirit of cooperation even while you achieve your financial target.

3) Halal Savings

The halal savings provided by Cowrywise allows Muslims and people of other Faith’s save with zero-interest banking. This system is built solely for people of the Muslim faith in mind. In case you didn’t know, it goes against the Muslim faith to receive interests, its source notwithstanding. This should in no way prevent them from saving.

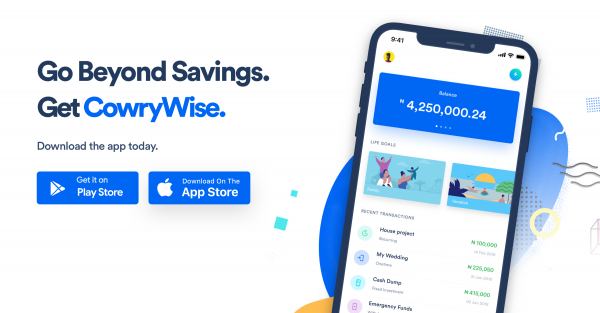

4) Life Goals

Last but not least on our list is this savings plan. Everyone has life goals, in many cases achieving them requires a fair amount of investment.

With Cowrywise, you can finally save with a special life goal account. With this account, you can highlight your goals and even create thresholds to monitor your progress.

This savings plan also allows automation. With this account, you can make deposits at any time you desire. Funds saved on this account can only be withdrawn after a minimum period of one year.

Is Cowrywise Secure? – Cowrywise Review

One of the most common concerns of potential Cowrywise users is its level of security. As potential investors, it is only natural to be wary about the credibility of a platform.

However, there is no need to worry, your investments are safe and secure. Cowrywise has proven to be reliable in terms of assets management over the past few years.

As a legally recognised FinTech company in Nigeria, in every sense of the word, they can be recognized as a legal entity. Savers funds are securely held by Meristem Trustees, which is a secure platform legally registered under the Securities and Exchange Commission (SEC).

With an arsenal of investment and fund managers at their disposal, they do an awesome job making returns for customers.

Would you like to learn more about savings and investment applications? Click here to check out our full PiggyVest Review.

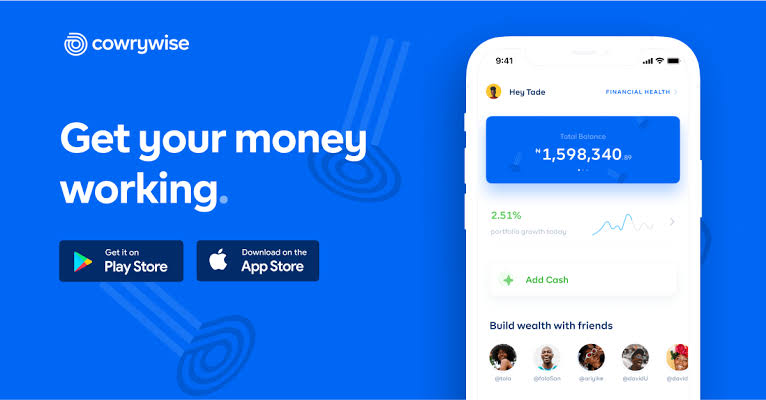

The Cowrywise App – Cowrywise Review

In our current digital age, applications are amazing mediums for gaining access to a plethora of services. Financial Services are in no way different.

Like many fintech companies, Cowrywise makes its services available on a mobile app. With your smartphone, you can get access to all their services.

With its well built and user-friendly interface, users can easily navigate the app with ease. With the Cowrywise app available on Google PlayStore and Apple AppStore, accessibility is not an issue.

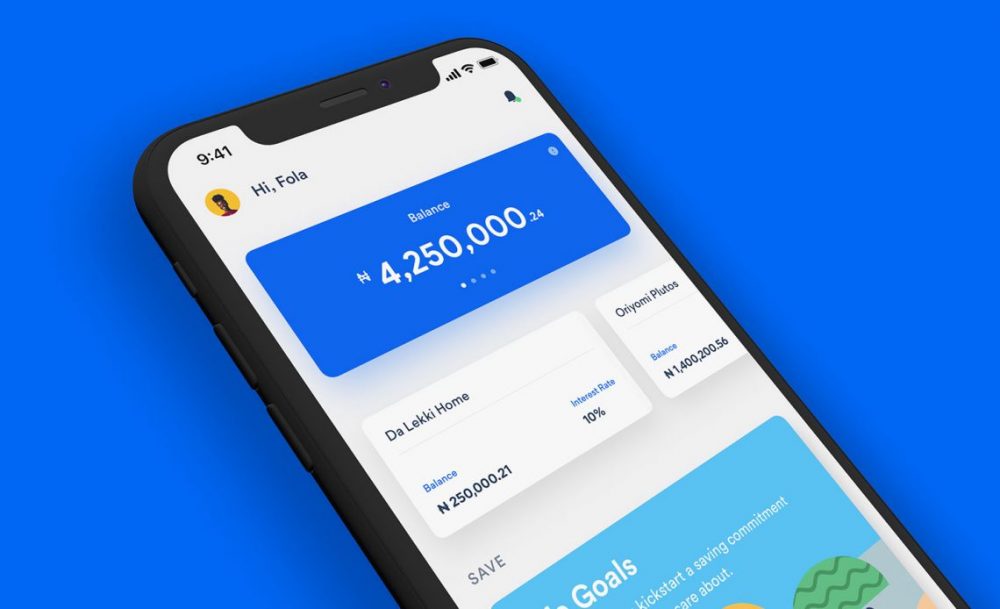

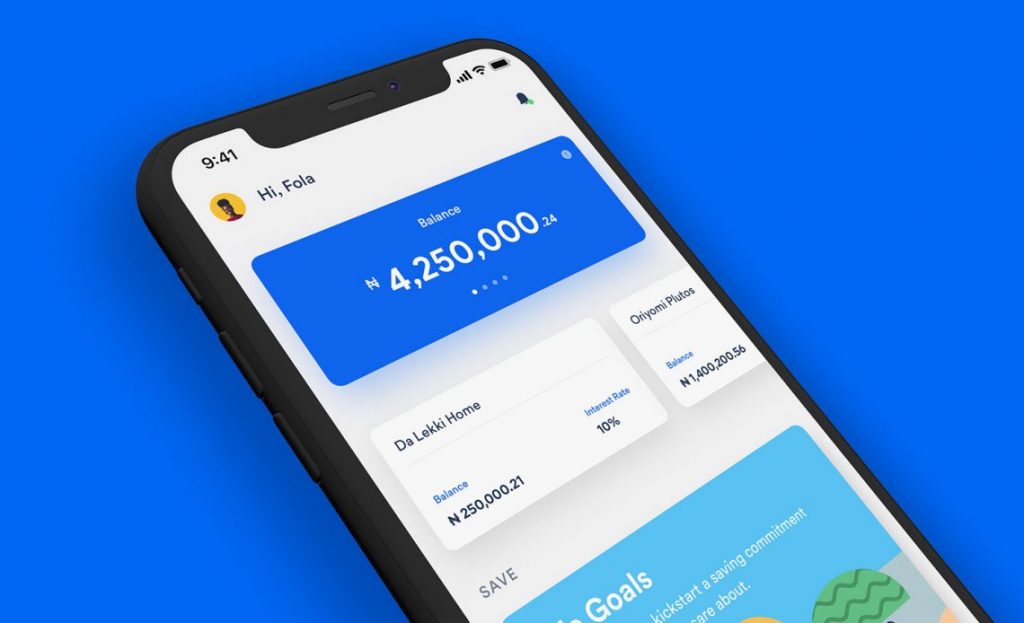

With the Cowrywise app, you can perform the following activities:

- Carry out all your savings and investments endeavours seamlessly.

- Monitor and manage your investments effectively.

- With your mobile app, you can also easily monitor your returns on your savings and investments at any time.

- Withdrawals can be made on your account with ease from any account you have invested your money in.

- Access to the app makes it easy to access the customer care interface. They have a strong support system. This system allows them to effectively address all issues that arise.

Generally, the Cowrywise app has a smooth and refined feel to it. In terms of functionality, there are only a few malfunctions that pop up once in a while.

In some cases, customers complain about the app making unnecessary pop-ups like telling them to download updates, even when they have an updated app.

Asides from some minor issues, the core app functions like deposits, withdrawal and asset monitoring work smoothly.

How To Register A Cowrywise Account – Cowrywise Review

I believe that the best part of this Cowrywise review is where I show you how to take action.

To begin your journey on Cowrywise, all you have to do is complete a few simple but important steps. Let’s take a look at them.

1) Step one

To begin the process, all you have to do is visit the Cowrywise website. They have a user-friendly website that gives brief explanations on details about all the financial services and products they offer. If you don’t want to take that route, you can go for a more direct approach. All you have to do is head to the PlayStore app or apple store.

2) Step two

When you complete the installation of the app, the next step is to set up your account. Setting up an account requires that you fill a sign-up. Signing up for a free account requires that you complete a simple form. Details like your name, email address and card details will be required. You don’t have to worry, your confidential details are safe.

3) Step three

Add a payment method. Adding a payment method requires that you submit your card details. To perform transactions like deposits and withdrawals on this app, having your bank card connected is important. Without it, you cannot take full advantage of the features this app has to offer.

4) Step four

This is the fourth and final step. With profile complete and important details provided, you are good to go. This step entails the actual process of making a deposit into your savings account or making an investment. Whatever your choice may be.

How to withdraw your money from your Cowrywise

When talks about a new fintech or investment company come up, one of the first questions people ask is, “have you been able to withdraw your money?”. The overall withdrawal process is designed to be easy and seamless and instantaneous.

To start the process, all you need to do is request a withdrawal. This process is easy to execute, let’s take a look at the processes:

- Step one:

To begin, you need to log in to your Cowrywise account.

- Step two:

Next, all you have to do is select a wallet you want to withdraw from. If any of your savings plans have matured, you can easily select them for withdrawal.

- Step three:

After the previous step has been completed successfully, to proceed, all you have to do is click on “withdraw”.

- Step four:

The next step is to enter the amount of money you want to withdraw. You can also select the account you want to withdraw your money to. The options include withdrawing directly to your bank account or stash account.

- Step Five:

The last and final step is to select a new maturity date. If this last action, you will be able to make your withdrawal.

What Is The Cowrywise Stash? – Cowrywise Review

As the name implies, stashing funds away can be particularly helpful at different points in time.

Stash is a unique feature of the Cowrywise app, simply put, it is a pool of money that is made up of revenue received from the sale of mutual funds.

Stash is also equipped to allow users to make transfers from any of their bank accounts into it.

This allows customers to easily transfer money directly into their savings or investment plan. As an added feature, you can also easily make transfers to other Cowrywise users. For a small fee of N25, you can make transfers to any bank of your choice.

FAQ – Cowrywise Review

How do you make money on Cowrywise?

Cowrywise offers several opportunities for users to make a consistent flow of income on their app. There are two major means of growing your finances on this platform, they include:

- Saving

- Investing

There is one other way for users to make money on the platform. This method is based on a referral system. This system allows you to make money by inviting your friends and family to use this platform.

Cowrywise Interest Rates

When it comes to investing and saving, considering how much you stand to receive on interest is important. Cowrywise offers attractive interest rates to their customers across all accounts and investments.

Interest rates on this platform on this platform are not static. Interests are dynamic, it can amount to anything between 5% per annum to 12% per annum.

In general, Interest rates are determined based on current market rates. Therefore without that range in effect, the fluctuations cannot be effectively monitored.

What does Cowrywise do with depositors funds?

When you make a deposit, your assets are invested into secure and profitable money market securities.

What are Money market securities?

Money market securities are regarded short term assets that usually have a maximum of one year maturity period.

Some of these high yielding securities include the following:

- Treasury bills

- Bankers acceptances

- Commercial papers.

The aim of Cowrywise as a brand is to guarantee the safety and growth of client funds. As we have previously mentioned, for extra security, customer funds are held by Meristem trustees.

How do I delete my Cowrywise account?

If the need is, you can deactivate or delete your Cowrywise account by contacting customer care.

Conclusion – Cowrywise Review

Cowrywise provides an awesome opportunity for individuals to save and invest while taking advantage of their smooth and user-friendly experience. I hope that this Cowrywise review will help you make the necessary choices that will affect your future finance

- How To Sell Unwanted Gift Card For Cash - March 7, 2024

- Does Circle K Take Google Pay? - January 31, 2024

- Where To Redeem Gift Cards In Nigeria - January 31, 2024

2 Replies to “Complete Cowrywise Review: Everything You Need To Know”